As a business owner with bad credit, getting approved for a business loan can feel like an uphill battle. Feels overwhelming, right? But it’s not the end of the road. There are options available out there. The right small business loans for bad credit can provide the funding you need to grow, without tying up your personal assets at risk.

This blog explores the best small business loans for bad credit, offering real solutions for moving forward despite poor credit. Let’s get into it:

How to Overcome Bad Credit and Secure Business Funding

For many small business owners, bad credit feels like a barrier to growth. However, it doesn’t have to stop you. While traditional lenders might reject your application, business funding for bad credit has got you covered for your needs. Today, there are more alternative business financing options for poor credit than ever before.

Lenders are becoming more flexible, offering loans like unsecured business loans for bad credit, online business loans for bad credit, and microloans. The market for business loans for bad credit is more diverse, offering tailored solutions for your business’s unique needs. With the right approach, bad credit won’t hold you back from securing funding and scaling.

Check out our guide: How to Build Business Credit From Scratch. It walks you through the exact steps to strengthen your credit profile so you can qualify for better loans, lower rates, and higher limits.

Funding Options for Business Owners With Bad Credit

Now, let’s dive into the 7 funding options that can save you:

Microloans for Bad Credit

Microloans are a fantastic option if you have bad credit.

- These smaller loans are designed for new or small businesses that may not qualify for traditional financing.

- Microloan programs, like those offered by the SBA, are especially helpful for startup business loans for bad credit.

- They are easier to obtain, offer smaller amounts, and have flexible repayment terms.

It is a great choice for businesses seeking small business loans for bad credit.

SBA 7(a) Loan for Bad Credit

SBA 7(a) loans are among the best small business loans for bad credit.

- While these loans are designed for small businesses, they come with lower interest rates and longer repayment terms.

- Even if your credit isn’t perfect, you might still qualify.

- The business loan eligibility criteria for SBA loans focus more on your business performance and repayment ability than on credit score alone.

It is a good option for business funding with bad credit.

Secured Business Loans

Secured loans require you to pledge collateral, such as property or equipment.

- For businesses with bad credit, this option helps you secure a small business loan for bad credit by offering security for the lender.

- These loans are backed by assets.

- They come with better terms than unsecured loans, even for those with low credit scores.

It is a great option for businesses with valuable collateral but poor credit.

Online Business Loans for Bad Credit

If you need business funding with bad credit and need it quickly, online business loans for bad credit are an excellent choice.

- These loans are faster and more flexible than traditional bank loans.

- Online lenders often don’t have strict credit score requirements, so they can be a good fit for entrepreneurs with poor credit.

- If you are facing challenges due to a low credit score business loan (e.g. 500), these online loans provide a great opportunity for quick access to the capital you need.

It is a strong option for fast business loans for bad credit.

Business Line of Credit for Bad Credit

A business line of credit for bad credit works like a credit card.

- It allows you to borrow as needed and repay over time.

- It is a revolving credit line, which means you can use it whenever your business needs working capital loans for bad credit.

- This flexibility makes it perfect for businesses with fluctuating cash flow.

Even if your credit isn’t perfect, it’s a great way to access funds without a large lump sum payment upfront.

Invoice Financing

If you are waiting on customer payments but need cash now, invoice financing might be a lifesaver.

- It lets you borrow money against outstanding invoices, providing quick cash flow without a perfect credit score.

- Since the loan is backed by your accounts receivable, it’s an ideal bad credit small business funding option.

- It gives you fast access to cash without relying on traditional credit checks.

This option is especially helpful for businesses with poor credit.

Unsecured Business Loans for Bad Credit

For business owners with no collateral, unsecured business loans for bad credit are a viable option.

- These loans don’t require you to put up assets like property or equipment as security.

- They typically come with higher interest rates due to the risk for lenders.

- The best thing is that they offer no-collateral business loans for bad credit.

This flexibility makes unsecured loans a fast and easy option for businesses that need quick cash.

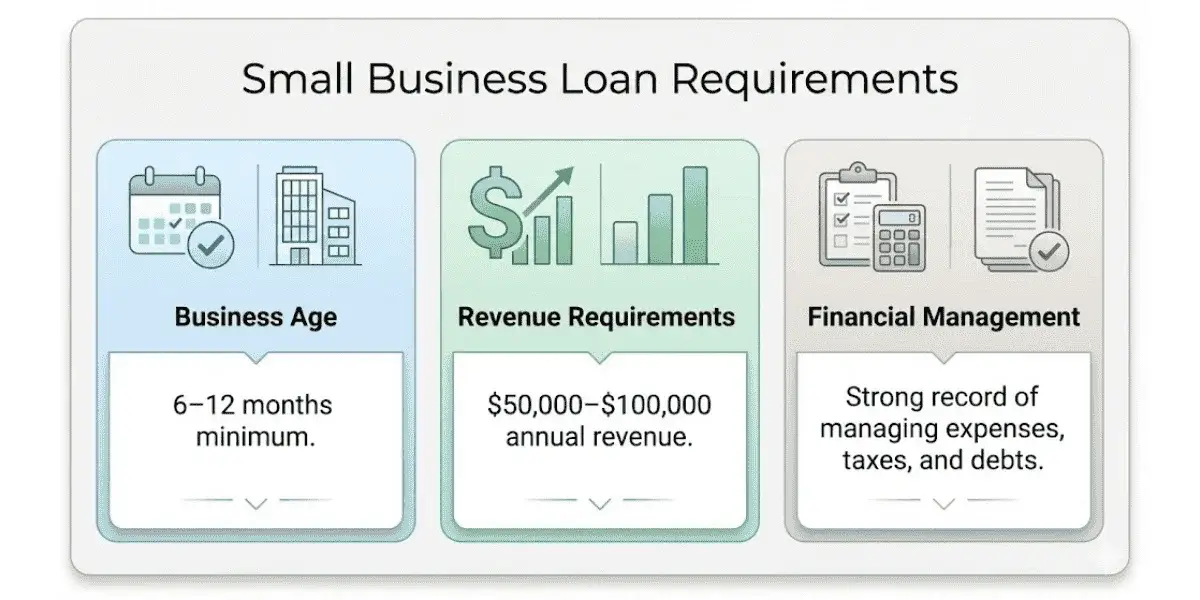

How to Improve Your Chances of Getting a Business Loan with Bad Credit

Improving your chances of approval for a small business loan for bad credit can be challenging, but it’s absolutely possible with the right steps. Here’s how to increase your odds:

Improve Your Credit Score

Start by checking your credit report. If there are any errors, dispute them. Pay down existing debts and keep your credit utilization low to improve your score.

Reduce Outstanding Debt

Lowering your debt-to-income ratio will make your business more attractive to lenders. Focus on paying off high-interest debts first.

Offer a Co-Signer

If your credit is a barrier, having someone with better credit co-sign your loan can make lenders more confident in your repayment ability.

Increase Your Business Revenue

Demonstrate a consistent increase in business revenue. It will show lenders that your business can generate the income necessary to repay the loan.

Provide Collateral

When you offer collateral for your loan, it reduces the lender’s risk. It can strengthen your application and increase your chances of approval, even with a bad credit score.

Tip: Prepare for your application by gathering all necessary documents, like financial statements, tax returns, and a detailed business plan. It will help streamline the process and boost your credibility.

Common Reasons Business Loans Are Denied

Even with bad credit, a business loan is possible, provided you address common barriers.

Here are some typical reasons business loans for bad credit get denied:

- Low Credit Score: Lenders often set a minimum credit score requirement for loan approval. If your score doesn’t meet this, your application may be rejected.

- Insufficient Revenue: If your business doesn’t have enough revenue to cover repayments, it could lead to denial.

- Poor Business Plan: A weak or incomplete business plan fails to convince lenders that you have a solid path forward.

Tip: To improve your chances, work on fixing these issues. Boost your credit score, increase business revenue, and create a detailed business plan that clearly outlines your goals and financial projections.

Conclusion

Bad credit doesn’t mean your business funding options are limited. By exploring alternatives like microloans, SBA loans, and online business loans, you can find the right path for your business to grow. Take actionable steps to improve your credit and meet the requirements for small business loans for bad credit. Ready to start? Check out our Small Business Loan Approval Guide to continue your journey toward securing the funding you need.