As a business owner, you have probably felt the weight of needing funding but struggling to get approval. No doubt that it is a tough spot, especially in 2026 when lenders have tightened the strings. But getting a small business loan doesn’t have to be a mystery. Understanding the approval process and what lenders are actually looking for can make all the difference.

This guide covers everything you need to know, from small business loan requirements, your credit score, and the small business loan application checklist, to ensure you are ready when the time comes.

Let’s get you on the path to approval.

All You Need to Know About Small Business Loans

A small business loan isn’t just about securing cash. You can call it a lifeline for business growth. If you are expanding, covering payroll, or managing day-to-day expenses, the right loan can propel your business forward. But before moving further into the process, it is important to understand what you are signing up for.

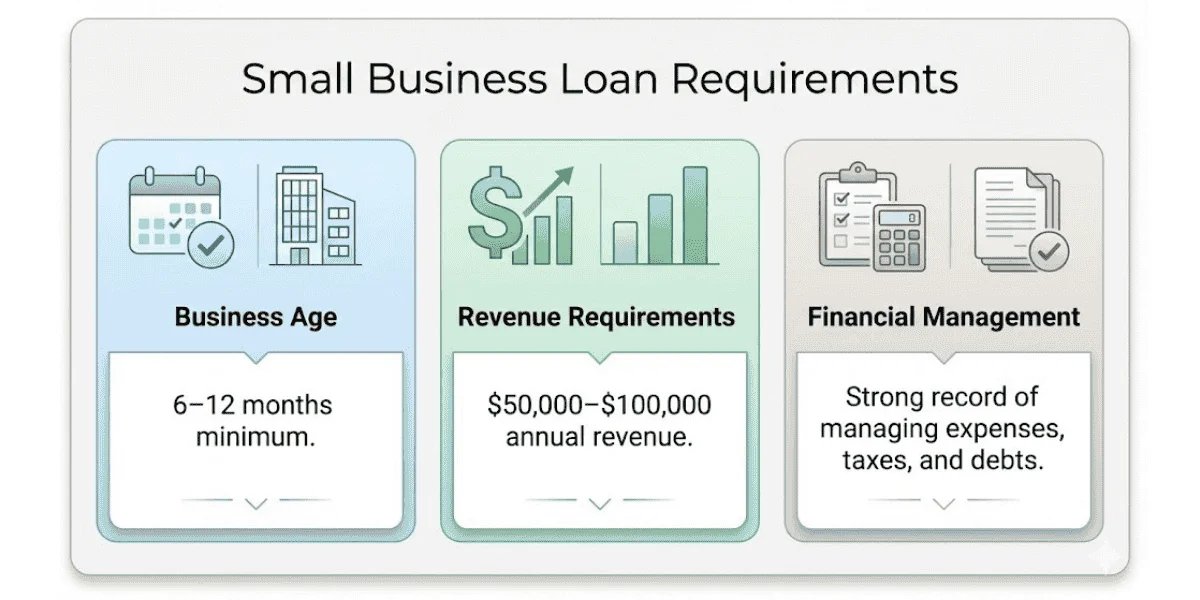

So, a small business loan is money borrowed from a lender that you will repay over time, usually with interest. It’s not as simple as just applying; there are specific small business loan requirements lenders look for:

- Business Age: Lenders typically want to see that your business has been running for at least 6–12 months. Startups might struggle to get approved unless they have a solid business plan and financial backup.

- Revenue: Your business must have consistent, verifiable revenue. Lenders often require a minimum annual revenue (typically $50,000–$100,000) to ensure you can repay the loan.

- Financial Management: Lenders will evaluate how well you manage your finances. Are you staying on top of expenses, taxes, and debts?

So, what do lenders look for in a small business loan? They assess your ability to repay by reviewing your financials, business credit history, and business loan eligibility criteria. A good credit score helps, but it isn’t the only factor. If your business can handle debt responsibly, lenders are more likely to approve your loan.

Small Business Loan Requirements

Securing a small business loan begins with meeting certain small business loan requirements. Lenders want to ensure that you’re not only creditworthy but also capable of handling the responsibility of borrowing.

Here’s what they will generally look for:

Business Age

Most lenders prefer that your business has been running for at least a year. Newer businesses may have more difficulty, but not all lenders require a long track record.

Revenue

Lenders want to see that your business can generate consistent revenue. While the exact amount varies, most lenders look for at least $50,000–$100,000 annually to ensure you can handle repayments.

Legal Status

Your business must be legally registered (LLC, Corporation, etc.). If you are a sole proprietor, it can be harder to get a loan.

Curious about how loans stack up against grants for your business? Dive into our Grant vs Loan: Which Is Better for Your Business? guide to weigh your options.

How to Get Approved for a Small Business Loan

Securing a small business loan isn’t just about having a good idea. It’s about proving that your business is financially stable and ready for growth. Here’s how to get approved for a small business loan in 2026:

Assess Your Eligibility

Make sure your business meets the basic requirements, such as age, revenue, and legal standing. Without this foundation, approval becomes much harder.

Understand Credit Score Expectations

While your minimum credit score for a small business loan should be at least 650, remember, lenders also consider other factors. If your score is on the lower end, consider working on improving it before applying.

Prepare Necessary Documents

Lenders want to see proof of your business’s financial health. This includes:

- Tax Returns (usually 2–3 years)

- Financial Statements (balance sheet, P&L, etc.)

- Business Plan (especially for startups)

- Legal Documents (EIN, business licenses)

Submit Your Application

With everything in place, you’re ready to submit. But remember, timing matters. Some lenders move quickly, while others can take weeks to process your application. Be prepared for this wait.

How to Increase Chances of Getting a Business Loan

If your credit isn’t perfect, don’t stress. There are several easy ways you can increase your chances of getting a business loan.

Here’s how to boost your approval odds:

- Improve Your Credit Score

A higher credit score shows lenders you are responsible for debt. Pay down existing debts, and ensure you don’t miss payments moving forward.

- Reduce Outstanding Debts

The less you owe, the better. Try to reduce high-interest debts to lower your debt-to-income ratio, which will make you a more attractive candidate.

- Offer Collateral or a Personal Guarantee

If you are willing to back up your loan with assets or a personal guarantee, lenders may feel more comfortable approving your application, even with a less-than-ideal credit score.

- Provide a Solid Business Plan

Lenders want to see a clear, detailed business plan outlining your vision, goals, and how you will use the loan. A solid plan increases trust and shows that you’ve carefully thought out your business’s future.

- Demonstrate Consistent Cash Flow

Even if your credit score isn’t great, showing stable and predictable cash flow assures lenders that your business can handle loan repayments.

If you are specifically seeking funding for working capital or payroll, our Working Capital & Payroll Funding Guide offers tailored strategies to help you secure the funds you need.

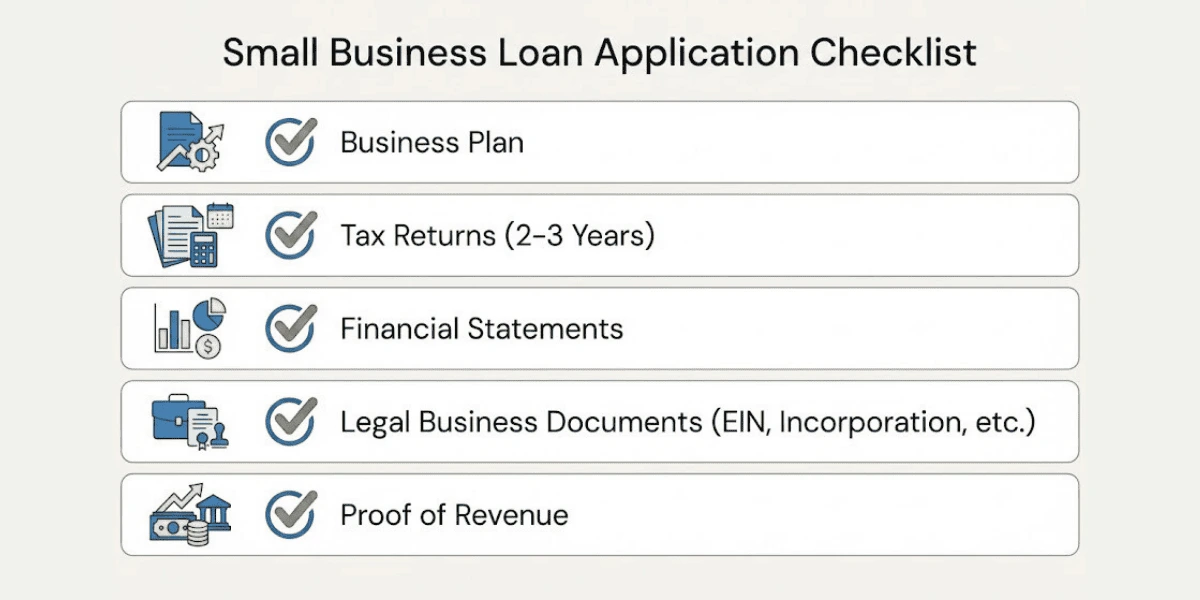

Small Business Loan Application Checklist

Applying for a small business loan is a crucial step in securing funding, and having the right documentation ready can make all the difference. The process isn’t one-size-fits-all, but following a comprehensive small business loan application checklist can simplify it. Here’s what you will need:

- A Business Plan

A clear business plan is essential. It should outline your goals, target market, financial projections, and how you’ll use the loan. Lenders want to see that you have a vision for your business’s future and that the loan will support its growth.

- Tax Returns

Lenders typically require at least 2–3 years of business tax returns. These documents help the lender assess your revenue and expenses. It provides a solid understanding of your financial health.

- Financial Statements

Be prepared with balance sheets, profit and loss statements, and cash flow statements. These documents provide a snapshot of your business’s financial status. They also help lenders evaluate your ability to repay the loan.

- Business Legal Documents

You will need your EIN, operating agreement, articles of incorporation, and any other legal documents that confirm your business’s legitimacy.

- Proof of Revenue

Lenders want to verify your income, so bring bank statements or contracts that show consistent or projected revenue.

Having all of these documents in place will ensure your loan application is smooth and strengthen your chances of approval. The more organized you are, the more likely it is that lenders will view your business as creditworthy.

Now, let’s talk about the minimum credit score required for a small business loan. Typically, a score of 650 or higher is necessary for traditional loans. But don’t panic if your score is lower. There are alternative options available, though they might come with higher interest rates or less favorable terms. If your credit isn’t ideal, check out our Bad Credit Funding Options Guide to explore other possibilities.

Small Business Loan Approval Process

The small business loan approval process might feel like a waiting game, but it doesn’t need to be stressful. Here’s a breakdown of what happens after you submit your application:

Step 1: Review of Financials

Lenders start by reviewing your financial statements to evaluate your business’s ability to handle additional debt. It includes looking at your revenue, expenses, and overall financial health.

Step 2: Credit Check

Your minimum credit score for a small business loan will be assessed, but this isn’t the only factor. Lenders also look at your business’s revenue, cash flow, and debt-to-income ratio to gauge your financial stability.

Step 3: Loan Decision

Based on their review, the lender will either approve or deny your loan application. If approved, they will offer terms such as interest rates and repayment schedules. If denied, take note of the reasons (e.g., low credit score or insufficient revenue) and improve those areas for future applications. For more insights, check out our guide on How Interest Rates Affect Business Loan Approval.

Step 4: Fund Disbursement

Once approved, funds are typically disbursed within a few days to a few weeks, depending on the lender and loan type. Be prepared for this wait, but know the funds can arrive sooner than expected.

Now you must be wondering:

How long does it take to get a small business loan?

So, on average, it can take anywhere from 7 days to 6 weeks, depending on the lender and the loan’s complexity.

Common reasons business loans are denied include poor credit history, insufficient revenue, or missing documentation. If you have been denied, don’t be discouraged. Take steps to strengthen your application for the next time.

DSCR Requirements and Underwriting Criteria for Small Business Loans

When applying for a small business loan, understanding the Debt Service Coverage Ratio (DSCR) is crucial. The DSCR requirements include:

- The DSCR measures your business’s ability to cover its debt payments with its available cash flow.

- It’s calculated by dividing your business’s net operating income by your total debt obligations.

- A DSCR greater than 1 means you have enough cash flow to cover debt, which signals financial stability to lenders.

- A lower DSCR may indicate potential challenges repaying loans, which could impact your loan eligibility.

Business Loan Underwriting Criteria

In addition to DSCR, lenders also evaluate underwriting criteria when assessing a loan application. By understanding the following factors and improving them, you can increase your chances of approval:

- Business Cash Flow: Lenders want to see consistent cash flow to demonstrate that your business can meet its financial obligations.

- Collateral: Offering assets as collateral gives lenders more confidence, reducing their risk.

- Financial Stability: Lenders examine your business’s ability to manage debt and make timely payments.

For a detailed breakdown of underwriting processes, check out our Underwriting & Approval Guide.

Conclusion

Securing a small business loan in 2026 doesn’t need to be overwhelming. By knowing exactly what lenders look for, checking off your small business loan application checklist, and strengthening your credit profile, you put your business on the path to success. The right loan can be the boost your business needs to grow. Follow the steps in this guide, and turn them into opportunities that fuel your business’s future.