For many small business owners facing a cash flow crunch, a Merchant Cash Advance (MCA) can seem like a lifeline. But what happens when that lifeline starts to feel like an anchor dragging your business under—especially when predatory lenders are behind the offer?

The reality is that the unregulated nature of this industry has given rise to a predatory merchant cash advance market that targets vulnerable entrepreneurs. Predatory lenders often focus on business owners who feel they have no other options. If you are losing sleep over daily withdrawals that are draining your operating capital, you aren’t alone.

This guide will help you identify the signs of a predatory MCA lender, understand your legal rights, and determine if you are the victim of a scam.

Am I Dealing with Legitimate or Predatory Lenders?

The first step is distinguishing between a legitimate, albeit expensive, financing product and a predatory one. A legitimate MCA is not technically a loan; it is the purchase of your future receivables. This distinction allows predatory lenders to bypass state merchant cash advance usury laws that typically cap interest rates on loans.

However, if your agreement is structured so that the lender takes absolutely no risk. It means you must pay them back regardless of whether your business makes sales or not. It may be a disguised loan. Predatory lenders often use “factor rates” (e.g., 1.5) instead of an Annual Percentage Rate (APR) to hide the true cost.

When you do the math, a high-interest merchant cash advance can effectively have an APR of 200% to over 1,000%. If the cost of capital is suffocating your business, you need to look closer at your contract and whether you’re dealing with predatory lenders.

Top Red Flags in Predatory Merchant Cash Advance Contracts

To spot a trap before it snaps shut, look for these specific red flags in merchant cash advance contracts used by predatory lenders:

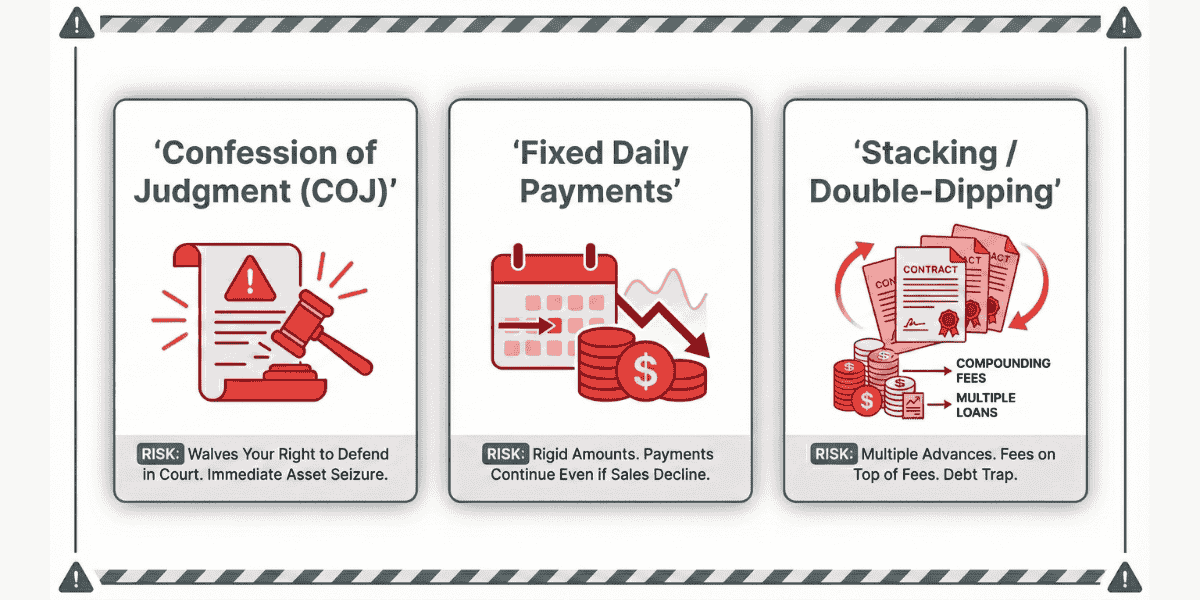

1. The “Confession of Judgment” Clause

One of the most dangerous, abusive merchant cash advance terms is the merchant cash advance confession of judgment (COJ). This clause essentially forces you to waive your right to a trial.

By signing it, you agree in advance that you are liable for damages if you miss a payment. This allows the lender to freeze your bank accounts and seize assets almost immediately, often without you even knowing a lawsuit was filed.

Note: New York has banned COJs for out-of-state borrowers, but many predatory lenders still attempt to use them or file in other states.

2. Fixed Daily Payments vs. Percentage of Sales

A true MCA should fluctuate with your revenue. If you have a slow week, your payment should drop. Predatory MCA lenders often set fixed daily or weekly payments that do not adjust. If your contract lacks a clear, easy-to-use “reconciliation clause” that allows you to adjust payments based on actual sales, it is a major warning sign that you may be dealing with predatory lenders.

3. “Stacking” and Double-Dipping

Be careful with lenders who push stacking, meaning they urge you to take another MCA while you are still paying off the first one. This is a classic tactic used to trap businesses in a cycle of debt.

Similarly, watch out for merchant cash advance scams involving “bait and switch” tactics, where you are promised a low rate that skyrockets at the last minute, or “double-dipping,” where a lender refinances your balance but charges a new set of fees on the entire amount, including the money you effectively just paid them back. These are hallmark behaviors of predatory lenders.

Harassment and Aggressive Collection Tactics

If you fall behind on payments, the behavior of the lender often reveals their true nature. Merchant cash advance harassment calls are a hallmark of predatory operations. While legitimate lenders will try to collect, predatory actors cross the line into illegality.

Common harassment tactics include:

- calling your customers or vendors to demand payment or defame your business.

- Threatening you with jail time (debt is a civil matter, not criminal).

- Using robocalls to bombard your business and personal lines.

- Threatening physical violence or harm to your family (a tactic seen in extreme cases like the FTC’s action against RCG Advances).

You have merchant cash advance legal rights. Under the Fair Debt Collection Practices Act (FDCPA) and various state laws, lenders cannot harass you. If predatory lenders are calling your family or threatening violence, you should document every interaction immediately.

Protecting Your Business from Predatory Lenders

Protecting your business from predatory lenders requires vigilance and due diligence. Before signing any agreement:

- Check for Lawsuits: Search for the lender’s name alongside terms like “merchant cash advance lawsuit” or “fraud.” A history of legal battles is a huge red flag and often signals predatory lenders.

- Verify the Broker: Many merchant cash advance scams originate with brokers who promise “guaranteed approval” or demand upfront fees. Legitimate lenders generally deduct fees from the advance amount, not beforehand. Predatory lenders and shady brokers tend to push upfront money.

- Read the Fine Print: Look for hidden fees (origination, facility, risk assessment, wire fees) that can strip 10-20% of your capital before it even hits your account. These kinds of hidden costs are a common tool used by predatory lenders.

You can also explore MCA Debt Relief: Legit Options vs Scams to understand safe ways to manage overwhelming MCA debt.

MCA Providers to Avoid: How to Spot Them

While we cannot list every bad actor, you can learn how to spot predatory business loans by avoiding providers who:

- Refuse to disclose the APR (even if they say “it’s not a loan,” they should be transparent about the effective cost).

- Rush you through the signing process (“Sign by 5 PM or the offer is gone”).

- Have no physical address or only use a P.O. Box.

- Ask you to lie on your application about your revenue.

Conclusion

Dealing with a predatory merchant cash advance can feel like a nightmare, but you are not powerless. By recognizing the signs of a predatory merchant cash advance, such as fixed payments, Confessions of Judgment, and harassment from predatory lenders, you can take the first steps toward reclaiming your financial freedom.

Do not let shame or fear stop you from acting. If you suspect your lender has violated merchant cash advance usury laws or engaged in fraud, you may have grounds to fight back. Documentation is your best weapon; keep records of all calls, emails, and contracts so you can hold predatory lenders accountable.

For a deeper breakdown of MCA mechanics, read our guide: Merchant Cash Advance: How It Works & Hidden Costs.