For many business owners, the most stressful part of the day is the morning bank balance check. Seeing your hard-earned revenue vanish via automatic daily withdrawals before you have even paid your staff is a suffocating feeling. You are certainly not alone in this struggle; industry data suggests that effective APRs on these advances frequently reach 350%, making repayment mathematically impossible for many. This predatory pricing structure forces thousands of entrepreneurs to seek MCA debt relief just to keep their businesses running. However, navigating debt relief can be risky. Scammers and unscrupulous companies target business owners in these vulnerable situations, promising quick fixes that often make problems worse.

Before you take action, it’s essential to understand the difference between legitimate financial strategies and offers that could put your business at greater risk.

How MCA Payments Can Overwhelm Your Business

To understand the solution, you have to understand the trap. The reason so many businesses require MCA debt relief lies in the contract structure itself. Funders categorize these deals not as loans, but as purchases of future receivables. By bypassing standard lending laws, they can impose aggressive daily remittance rates that effectively cripple your operating cash flow.

The spiral begins when that first daily payment becomes too heavy. To cover payroll or rent, you take a second position, then a third. Suddenly, your revenue is being siphoned off by multiple lenders simultaneously. It creates a mathematical impossibility where you owe more than you make.

At this desperate juncture, business owners often scramble to find out how to get merchant cash advance debt forgiven, only to realize that walking away isn’t as simple as closing a bank account. This vulnerability is exactly what predatory relief agencies are counting on.

Before you choose any MCA debt relief option, read Merchant Cash Advance: How It Works & Hidden Costs.

Spotting the Fakes: MCA Debt Relief Scams

The internet is flooded with experts promising to make your debt vanish. Unfortunately, MCA debt relief scams are rampant. These bad actors know you are vulnerable and use aggressive tactics to take what little cash you have left.

Here are the red flags to watch for:

- Guaranteed Forgiveness: No legitimate company can guarantee that a funder will forgive the entire debt. If someone promises 100% forgiveness with zero consequences, run.

- Upfront Fees Without Service: Scammers often demand massive upfront fees for MCA debt relief programs and then disappear or do the bare minimum, leaving you in a worse position.

- Fake Government Programs: Be very careful of callers claiming to represent a federal MCA bailout initiative. These do not exist.

- Advice to Just Stop Paying: While stopping payments is sometimes part of a strategic legal process, a scammer will tell you to stop MCA daily payments without a legal defense strategy in place. This exposes you to frozen bank accounts and aggressive lawsuits.

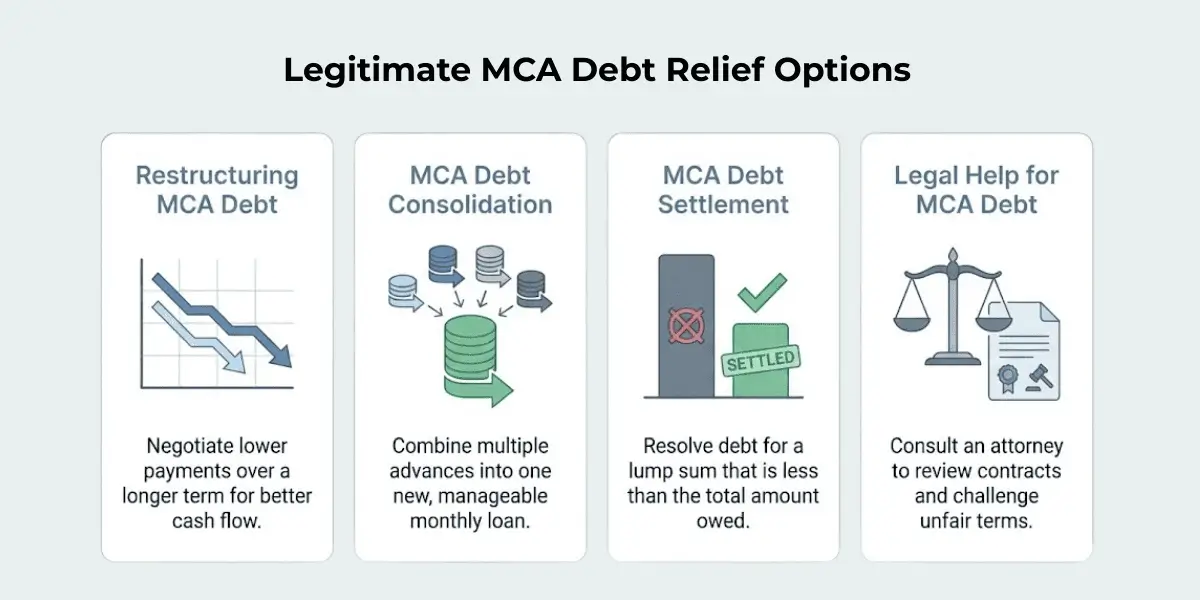

Legitimate Options: Real Ways to Find Relief

Finding the best MCA debt relief companies or attorneys requires diligence, but legitimate help does exist. Real MCA debt relief isn’t about magic tricks; it’s about leverage, law, and negotiation. Here is a breakdown of legitimate paths you can take.

Restructuring Merchant Cash Advance Debt

If your cash flow is tight but not critical, you might not need a full settlement. Restructuring merchant cash advance debt involves changing the terms of your current agreement. This usually happens through a reconciliation.

Since MCAs are based on future sales, if your sales drop, the funder must adjust your daily withdrawal amount to reflect that drop. You can demand a reconciliation directly from your funder to reduce merchant cash advance payments without hiring a third party.

MCA Debt Consolidation

For businesses with decent credit that are just stuck in a high-interest trap, MCA debt consolidation is a solid option. This involves taking out a lower-interest term loan (like an SBA loan or a secured business loan) to pay off the high-interest MCAs in one lump sum.

This immediately stops the daily drain and replaces it with a manageable monthly payment. However, qualifying for this can be difficult if your credit score has already taken a hit from the high daily withdrawals.

MCA Debt Settlement

This is the most common form of MCA debt relief for distressed businesses. MCA debt settlement involves negotiating with the funder to pay back a reduced lump sum, often significantly less than the original balance.

To settle a merchant cash advance for less, you typically need to prove financial hardship. This is where professional help shines. Experienced negotiators know that funders would rather get something than nothing.

They can help you negotiate lower MCA payments or a final buyout price that your business can actually afford.

Legal Help for MCA Debt

When funders become aggressive and start threatening customers or freezing bank accounts, you need legal help for MCA debt. Specialized attorneys can review your contracts for illegal terms.

In many cases, MCA contracts are poorly written or cross the line into illegal lending. A lawyer can use these violations as leverage to avoid bankruptcy with MCA debt relief. They can file counterclaims or defend against Confession of Judgment (COJ) tactics, giving you the breathing room to restructure or settle.

Business Debt Restructuring for MCAs

If you have multiple positions, general business debt restructuring for MCAs might be the holistic approach you need. This looks at your entire balance sheet, not just the advances. A restructuring firm acts as a buffer between you and the creditors. They manage the communication, allowing you to focus on operations.

The goal here isn’t just to cut costs, but to save the business. By using a legitimate MCA debt relief strategy, you ensure that your revenue goes back to buying inventory and paying employees rather than servicing predatory debt.

For a comprehensive, step-by-step guide on strategic recovery, read our article: How to Exit an MCA Without Shutting Down Your Business.

Conclusion

Escaping the grip of predatory financing is possible, but it requires swift, informed action. Whether you choose merchant cash advance debt relief through legal intervention, consolidation, or settlement, the key is to act before your bank account hits zero. Do not let the fear of scams paralyze you.

Legitimate MCA debt relief can provide the fresh start your business deserves. If you are drowning in daily payments, take the first step today: review your contracts, check your sales numbers, and reach out to a verified professional.