Building a strong financial foundation is essential for any business aiming to grow. A company’s credit score acts as a behind-the-scenes partner in every major financial decision, shaping access to favorable vendor terms, lines of credit, and efficient cash flow management. For many entrepreneurs, understanding this critical metric begins with the business credit score, a trusted benchmark developed by Dun & Bradstreet (D&B). This guide explains how the PAYDEX score works and highlights the broader financial health indicators that lenders and institutions examine, offering a comprehensive view of how business credit is evaluated beyond just historical payment patterns.

Demystifying the PAYDEX Score: The Business Credit Reliability Index

The PAYDEX score is a dollar-weighted numerical measure created by Dun & Bradstreet (D&B) to evaluate a company’s payment history with vendors and suppliers over the past 12 months. Lenders, suppliers, and potential business partners often rely on this score to understand a company’s creditworthiness and ability to meet financial obligations.

The Foundation: The DUNS Number Requirement

Before a business can build a D&B credit file and receive a corporate payment score, it must obtain a unique nine-digit identifier called a DUNS number. This number is essential for separating a business’s credit from the owner’s personal credit history. Creditors, vendors, and even government agencies use the DUNS number to check a company’s financial health before offering trade credit or contracts. Securing this identifier is the first step toward establishing a measurable business credit profile.

Unique Calculation Methodology

The PAYDEX score differs from personal credit scores because it is dollar-weighted. This means the size of a transaction affects its impact on the overall score. Paying a large invoice on time has a much greater positive effect than paying a small invoice, while a late payment on a high-value transaction can significantly hurt the score.

The score is based entirely on trade experiences reported by suppliers participating in the D&B Trade Exchange program. This emphasizes the importance of strategic payment management. If cash flow is tight, delaying a smaller invoice is less harmful than delaying a major payment.

It’s also crucial to ensure that key vendors report their payments to D&B. Paying suppliers who do not report can leave your score lower than it should be.

Interpreting the 1-100 Paydex Score Range

PAYDEX scores range from 1 (highest risk) to 100 (lowest risk). A score of 80 or higher indicates low risk, showing the business pays on time or early. The difference between a good and an excellent PAYDEX score comes down to how early payments are made.

A score of 80 means payments are made on time according to terms, while a score of 100 reflects payments made 30 days or more before the due date, signaling strong financial health and access to capital.

PAYDEX Score Breakdown and Significance

| PAYDEX Score | Payment Performance | Payment Timing | Risk Assessment |

| 100 | Anticipates Payment | 30+ days ahead of terms | Lowest Risk |

| 90 | Discounts Taken | Early Payment | Low Risk |

| 80 | Prompt | Payment made within specified terms | Low Risk |

| 50-79 | Beyond Terms | 15 to 30 days late | Moderate Risk |

| 0-49 | Severely Late | 60+ days late or worse | High Risk |

You can also explore our guide on how to build business credit for a clearer path to strengthening your overall credit foundation.

How Lenders Evaluate Business Credit?

Lenders understand that a single metric, like the PAYDEX score, cannot fully reflect a company’s future risk. Business credit evaluation combines quantitative and qualitative analysis to predict a company’s ability to repay debt, going beyond historical payment behavior.

Beyond PAYDEX Score: The Predictive DNB Score Metrics

Lenders rely on the broader Dun & Bradstreet (D&B) suite, known as the DNB score system, which forecasts potential financial issues within the next 12 months. Key metrics include:

- Delinquency Predictor Score (DPS): Ranging from 101 to 670, the DPS estimates the likelihood of severely delinquent payments or default. Higher scores indicate lower risk. The score updates with new data, factoring in business age, location, and corporate connections.

- Failure Score: Ranging from 1,001 to 1,875, this score predicts the chance that a business may seek legal relief from creditors or cease operations without fully repaying debts within a year. It draws on public records, financial statements, historical payment behavior, and demographic data.

These metrics reflect a shift in commercial lending toward forecasting future financial stability. Beyond payment history, factors such as industry volatility, business age, and negative public information play a major role in the overall DNB score and credit decisions.

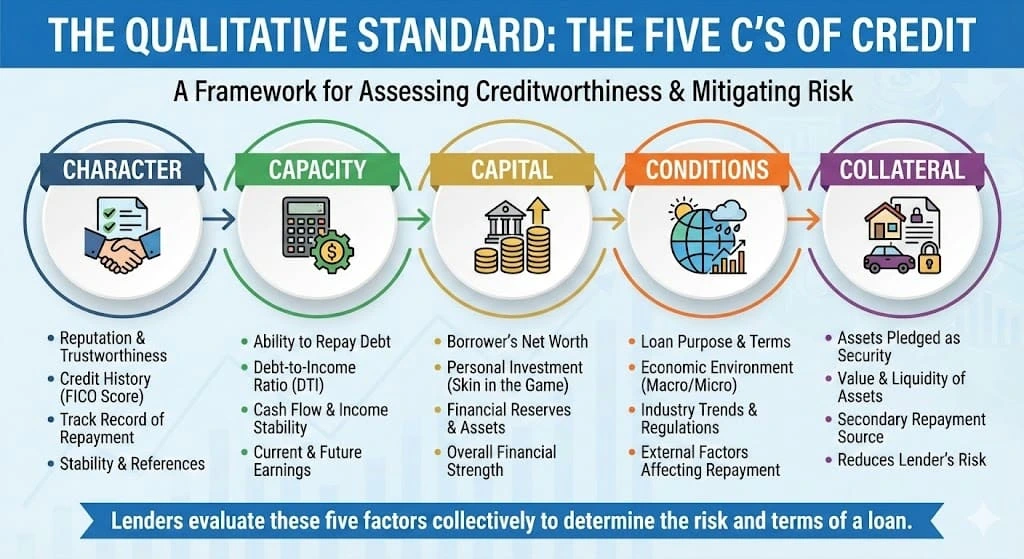

The Qualitative Standard: The Five C’s of Credit

Lenders also evaluate businesses using the “Five C’s” framework, which ensures the company has the foundational elements necessary for long-term repayment:

- Character: Measures the business’s willingness to repay, supported by a strong corporate payment score and a clean public record.

- Capacity: Assesses the business’s ability to generate enough cash flow to meet new debt obligations, determined through detailed financial analysis and key ratios.

- Capital: Examines the owner’s investment in the business, demonstrating personal commitment and providing a buffer during challenging market conditions.

- Conditions: Looks at external economic and industry factors that could impact repayment, such as market trends or regulatory shifts.

- Collateral: Evaluates assets pledged to secure the loan, reducing the lender’s risk if the business defaults.

Key Financial Health Metrics Scrutinized by Lenders

A strong business credit score alone cannot compensate for weak operational or financial health. Lenders pay close attention to a company’s operational capacity through financial ratios derived from its statements, with two metrics standing out as particularly critical.

Capacity Assessment: Debt-Service Coverage Ratio (DSCR)

The Debt-Service Coverage Ratio (DSCR) is one of the first numbers banks examine. It measures whether a business’s Net Operating Income (NOI) is sufficient to cover all debt obligations, including principal and interest payments.

DSCR is vital because it reflects the company’s ability to take on new debt. Lenders usually require a minimum DSCR between 1.2 and 1.25. A DSCR below 1.0 indicates the business cannot generate enough income to cover its debt, making approval unlikely. A ratio of 2.0 or higher signals strong financial stability.

Even a perfect commercial credit score cannot offset a low DSCR. Lenders often treat DSCR as a decisive metric: without sufficient cash flow, loans are typically denied. This highlights the importance of profitability and efficient management of operating income when seeking financing.

Managing Capital: Credit Utilization Ratio (CUR)

The Credit Utilization Ratio (CUR) measures the percentage of total available credit a business is using. High utilization may indicate overreliance on revolving credit and potential financial strain.

To support a strong credit profile and build lender confidence, businesses should aim for a CUR between 10% and 20%, with a maximum threshold of 30%. Utilization around 50% or higher raises red flags about excessive dependence on credit. Since CUR is controllable, managing it effectively demonstrates responsible credit behavior and can help secure more favorable lending terms.

Practical Strategies for Improving Your PAYDEX Score

Strengthening your PAYDEX score starts with consistent payment behavior and smart management of the trade lines that influence your rating. Since the score reflects how early you pay vendors, every step should support timely reporting and clear payment patterns.

- Pay Earlier Than Required

Aim to pay before the due date to move your score toward the higher range. Early payments carry the most weight, especially on larger invoices. Setting weekly payment reminders or using automated systems helps maintain steady progress.

- Work With Reporting Vendors

Your score depends on tradelines that appear in Dun and Bradstreet’s system. Confirm that your main suppliers report payment activity. If they do not, select additional vendors who participate in the reporting network. Even small tradelines can help if payments are made early.

- Prioritize High-Value Invoices

Since the PAYDEX score is dollar-weighted, payments on larger accounts influence your rating more than smaller ones. If cash flow creates timing pressure, handle the bigger invoices first, then manage the lower value ones.

- Keep Your DUNS File Updated

Make sure your information in D&B remains accurate. Outdated details or missing tradelines may slow progress. Reviewing your file regularly lets you catch missing payments or incorrect data before it affects your rating.

- Separate Personal and Business Spending

Use dedicated business accounts and credit cards. Clear financial separation helps create predictable payment behavior that supports a stronger score and builds trust with reporting vendors.

For a full breakdown, read what EIN-only credit is to understand how it works and how it strengthens your funding options.

By following these steps to improve your PAYDEX score, you not only strengthen your business credit profile but also position your company for better lending terms and financial opportunities

Conclusion

Securing the best financing requires both a strong business credit score and solid financial capacity. The corporate payment score reflects payment reliability, rewarding early payments with a score of 100, while lenders also consider the broader DNB score framework, including predictive risk metrics and operational capacity.

Maintaining a low Credit Utilization Ratio (under 20%) and a DSCR above 1.25 demonstrates full financial health, reducing lender risk. By taking deliberate steps to strengthen credit, companies can access better terms, lower costs, and unlock the capital needed for sustainable growth.