Most business owners admit that the underwriting stage feels intimidating simply because they have no idea what happens after they hit “submit.” Once you understand small business loan underwriting, the entire process becomes far less stressful, and your approval chances can improve dramatically.

This guide talks about what underwriters actually look for, how the evaluation works, how long it takes, and the criteria they use to decide whether your business is a safe bet. So, without further ado, let’s look into the details.

What Is Small Business Loan Underwriting?

Small business loan underwriting is the behind-the-scenes evaluation lenders use to determine whether your business is financially strong enough to borrow money. Think of it as a detailed risk assessment in which every part of your financial picture is examined. Underwriting matters because it directly affects whether you get approved, how much you qualify for, and the interest rate a lender feels comfortable offering.

To understand how small business loan underwriting works, imagine a lender trying to answer one key question: “Can this business realistically repay the loan on time?” By reviewing financial documents, credit scores, and operational stability, underwriters make a well-informed decision rather than guessing.

If you want a broader overview of how loan approvals work overall, check out the Small Business Loan Approval guide before diving deeper into underwriting.

The Business Loan Underwriting Process Explained

The business loan underwriting process is more structured than most applicants expect. It begins with a basic review of your application to confirm eligibility, followed by document verification, credit checks, and a deep look at your revenue and cash flow. It is to ensure your business can comfortably handle repayments. From there, underwriters score your risk level using financial models and industry benchmarks.

Here’s how the process typically works:

- Initial application review to confirm basic qualifications

- Verification of documents such as bank statements, tax returns, financial reports, and identification.

- Full credit check to assess payment history and current debt levels

- Cash flow and revenue analysis to determine repayment ability

- Internal risk scoring that evaluates financial ratios and industry risk

- Final decision based on combined financial stability and business performance

How long does business loan underwriting take?

As for the business loan underwriting timeline, online lenders may approve in as little as 24-48 hours. While banks and SBA lenders often take 1 to 2 weeks due to more thorough verification steps. Regardless of the timeline, the more organized your documents are, the faster the process tends to move.

What Do Underwriters Look For in a Business Loan?

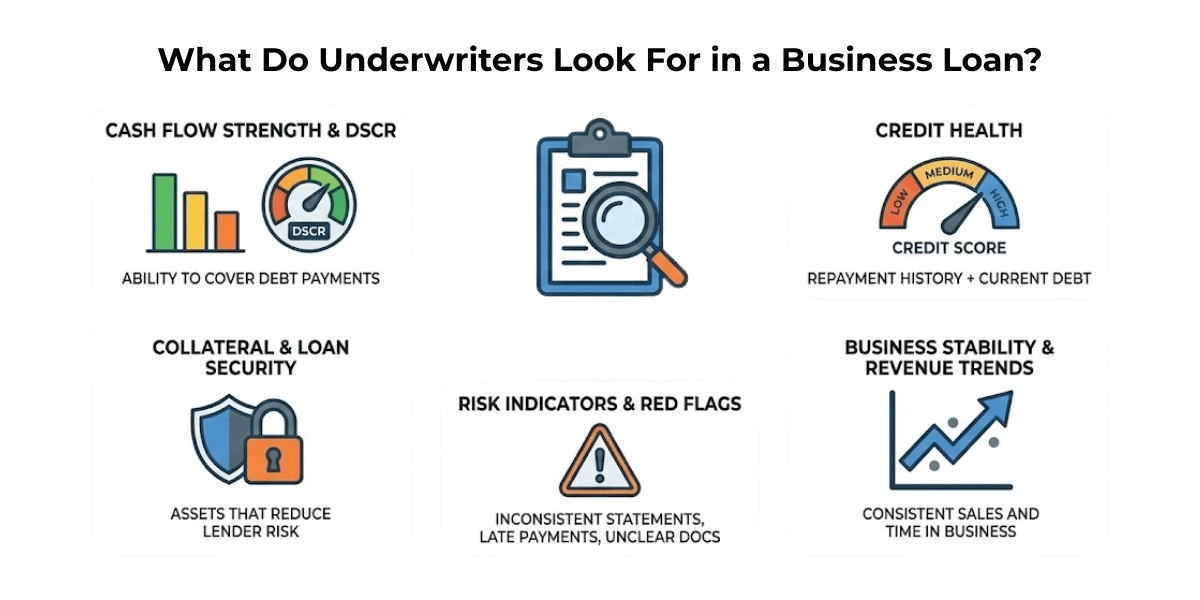

Many applicants wonder what do underwriters look for in a business loan, and the truth is: underwriters follow a very structured business loan underwriting checklist to determine whether your business can repay a loan without strain. During small business loan underwriting, lenders examine five core areas:

- Cash Flow Strength & DSCR

Your cash flow tells underwriters whether your business generates enough steady revenue to cover its expenses and loan payments. One key metric is the DSCR for business loans (Debt Service Coverage Ratio).

A DSCR above 1.25 is ideal because it shows you have a comfortable cushion, meaning repayment won’t push your business into financial stress.

- Credit Health

Underwriters review both personal and business credit, depending on the loan type. They look at repayment history, current debts, and overall reliability. The debt-to-income ratio for business loans helps them measure how much of your revenue is already committed to existing obligations.

- Collateral & Loan Security

Some loans require collateral, such as equipment, vehicles, or property. Underwriters calculate the loan-to-value ratio business loan to confirm the collateral is worth enough to secure the loan.

They also evaluate collateral requirements for small business loans, which vary by lender and industry.

- Business Stability & Revenue Trends

Time in business, consistent month-to-month sales, and predictable cash flow patterns help underwriters feel confident. Sudden dips may require explanation, but are not automatic disqualifiers.

- Risk Indicators & Red Flags

This is part of the lender’s business loan risk assessment. Common underwriting red flags include:

- Late or missing payments

- Inconsistent deposits

- Negative cash flow

- Unclear financial statements

Understanding these factors helps you avoid mistakes that often derail approvals.

Business Loan Underwriting Guidelines Every Owner Should Know

Most small business loan underwriting guidelines follow a similar structure, regardless of lender. At a high level, underwriters use a set of business loan underwriting criteria to evaluate your financial strength and long-term viability.

Here’s what nearly every lender considers essential:

- Revenue thresholds: Lenders want to see predictable monthly revenue that comfortably supports repayment.

- Credit score expectations: While requirements vary, higher scores reduce risk and improve loan terms.

- Industry risk levels: Some industries, such as restaurants and trucking, face higher volatility and require stronger financials.

- Legal + compliance checks: Underwriters confirm your business is properly registered, licensed, and in good standing.

- Business plan & cash flow forecasts: Lenders want to know how the loan will be used and how it contributes to future revenue.

These guidelines help lenders determine whether your business can reliably manage debt without compromising stability.

How to Prepare for Small Business Loan Underwriting

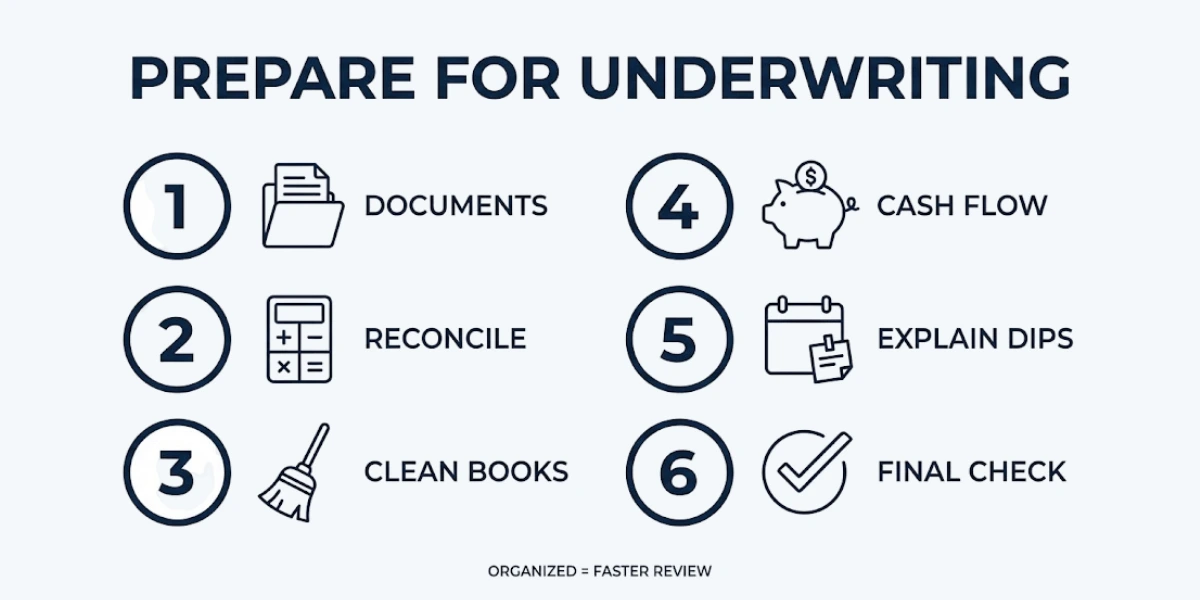

Preparing correctly can make underwriting faster and far less stressful. If you understand how to prepare for small business loan underwriting, you’ll avoid delays and show lenders you are organized and financially ready.

Here’s what to do before you apply:

- Step 1: Gather the documents needed for business loan underwriting: bank statements, tax returns, P&Ls, balance sheets, and your business license

- Step 2: Clean up financials by matching deposits to statements and fixing accounting errors

- Step 3: Remove outdated expenses and ensure revenue is clearly recorded

- Step 4: Strengthen your cash flow by reducing unnecessary spending or paying off small balances

- Step 4: Prepare explanations for seasonal or temporary drops in revenue

- Step 5: Double-check everything to reflect how small business loan underwriting works and present your business as trustworthy.

These steps help underwriters view your business as responsible, transparent, and financially stable.

Why Business Loans Get Declined in Underwriting

Many owners struggle to understand why business loans get declined in underwriting, but the reasons usually follow predictable patterns. Underwriters look for financial stability, and anything that raises doubt can trigger a denial.

Common reasons for denial include:

- Low DSCR that shows weak repayment ability

- Negative cash flow or inconsistent revenue

- Unverifiable income or missing documentation

- High debt ratios that signal financial strain

- Industry-specific risk concerns

- Poor business or personal credit history

All of these factors influence small business loan underwriting because lenders must ensure that approving your loan is a safe, responsible decision.

Conclusion

Once you understand what underwriters look for, the entire process becomes easy for you. With organized financials, strong cash flow, and clear documentation, your approval odds rise dramatically. Each step you take gives lenders confidence.

When your financial picture speaks for you, lenders listen. Build your foundation now, and the approvals you once stressed over will start to feel within reach.

FAQs

What documents are required for business loan underwriting?

Most lenders request bank statements, tax returns, financial statements, business licenses, and identification. Some may ask for revenue reports or a business plan.

Does bad credit affect underwriting approval?

Yes. Poor credit can increase perceived risk, but strong cash flow or collateral may still lead to approval.

Does collateral guarantee approval?

No. The collateral does not guarantee approval. Collateral helps reduce lender risk but does not replace the need for solid financials.

What financial ratios do underwriters use?

Common ratios include DSCR, debt-to-income, loan-to-value, and profitability metrics to determine repayment strength.