Many business owners walk into a lender’s office confident, only to leave shocked when the loan is denied. They often don’t realise that small-business loan interest rates quietly shape the decision. In 2025, rising rates have pushed lenders to examine risk more tightly than ever. When you understand how interest rates influence approval, payment calculations, and underwriting confidence, you stop guessing and start preparing strategically. This guide breaks down everything you need to know about small business loan interest rates so you can apply with clarity, not uncertainty. Let’s get into it.

Understanding Small Business Loan Interest Rates

It is important to understand what small business loan interest rates actually represent. At the simplest level, your interest rate is the lender’s price for taking a risk on your business. But in 2025, small-business loan interest rates fluctuated frequently in response to inflation, Federal Reserve decisions, the economy, and even the type of lender you chose.

When comparing offers, it is essential to understand APR vs interest rate (business loan).

- The interest rate is the amount you pay to borrow money.

- The APR includes fees and gives a more accurate picture of the total annual cost.

Most borrowers skip this distinction, but it’s key to understanding the actual cost of borrowing for small business owners.

Today, the average small business loan interest rate ranges widely. That means two businesses with similar revenue and goals may still receive different offers because lenders evaluate risk differently. Once you understand how these mechanics work, you will be better prepared for the rate a lender offers and why it’s not always the same as someone else’s.

If you want to understand how lenders evaluate risk behind the scenes, our Underwriting & Approval Guide breaks down the exact factors underwriters review before making a final decision.

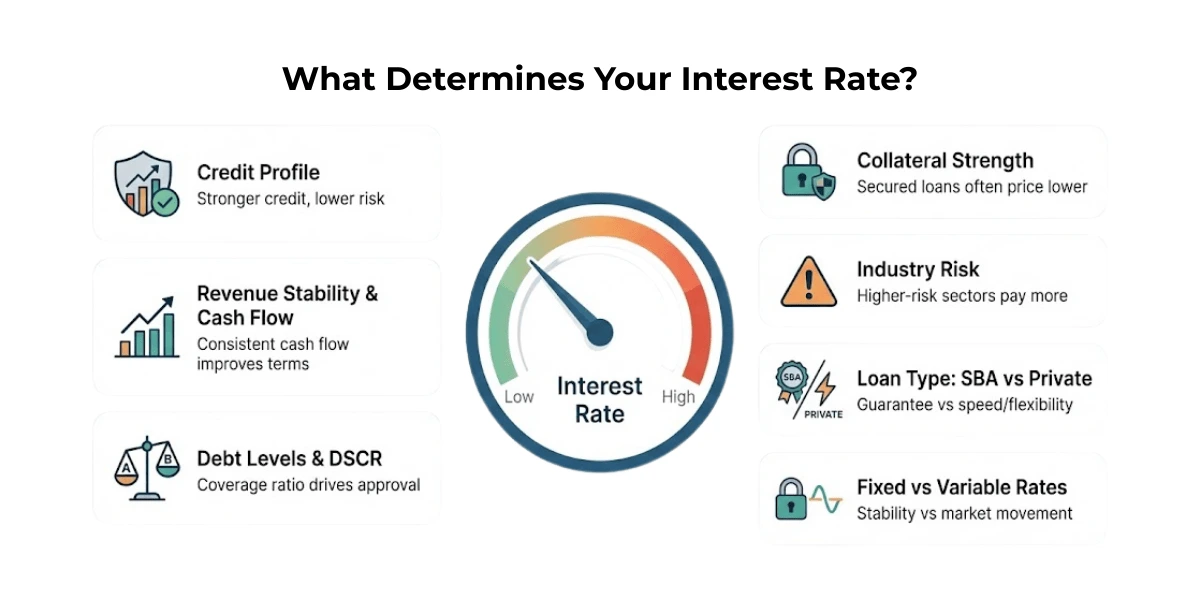

What Determines Your Interest Rate?

When lenders evaluate you, they use several factors affecting small business loan interest rates to decide what rate you qualify for, and whether you qualify at all. Here’s what shapes the final number:

Credit Profile

Both business and personal credit influence your rate. Lower scores signal higher risk, which means higher rates.

Revenue Stability & Cash Flow

Lenders want predictable income. Strong and steady cash flow helps secure better terms.

Debt Levels & DSCR

Your debt service coverage ratio indicates whether your cash flow can cover loan payments. Weak DSCR leads to higher rates.

Collateral Strength

Secured loans with strong collateral often receive lower rates because the lender has more protection.

Industry Risk

High-risk industries, such as construction, restaurants, and trucking, often see increased rates due to higher default rates.

Loan Type: SBA vs Private

SBA loan interest rates are typically lower because they’re government-backed, while online or private lenders charge more for speed and flexibility.

Fixed vs Variable Rates

Fixed rates stay constant; variable rates shift with the market. Lenders may offer variable rates when risk or market volatility is high.

All of these help lenders compare small business loan interest rates fairly and align pricing with actual risk.

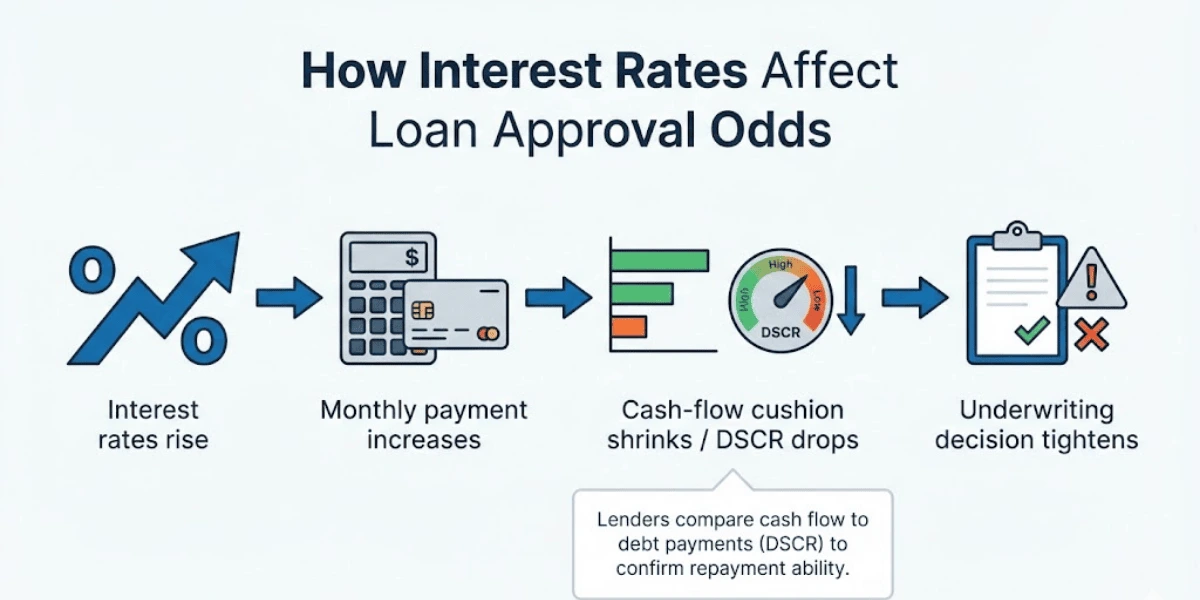

How Interest Rates Affect Loan Approval Odds

Most business owners assume interest rates only affect how expensive a loan becomes. But they also play a significant role in whether your application gets approved. When rates climb, lenders immediately test whether your cash flow can survive the higher monthly payments. If the numbers don’t hold up under stress, underwriting marks the file as too risky, even if everything else in your financial profile looks strong.

Here’s how interest rates affect business loan approval in real life:

- Higher rates = higher monthly payments, making repayment harder to justify on paper.

- Underwriters stress-test your cash flow to see if you can handle tougher payment obligations.

- The interest rate impact on loan payments lowers your DSCR, which is often the deciding factor for approval or denial.

- If your DSCR dips below the required threshold, even slightly, lenders may automatically decline the loan.

- In 2025, economic uncertainty and inflation led lenders to tighten standards, making approvals harder when rates rise.

- How rising interest rates affect small business loans is simple: bigger payments → weaker coverage ratio → fewer approvals.

- Interest rate hikes and business borrowing move together, meaning fewer borderline applications get approved during high-rate periods.

Understanding this allows you to prepare your financials in advance and apply only when your cash flow can comfortably support the projected payment.

Interest Rates Across Different Loan Types

Not all loans are priced the same. Each type comes with its own interest rate range, approval standards, and risk level. Understanding these differences helps you compare small business loan interest rates wisely before applying.

SBA Loans

Known for some of the lowest SBA loan interest rates because part of the loan is government-backed. Great for stable businesses with solid documentation.

Traditional Term Loans (Bank Loans)

Mid-range rates, predictable monthly payments, and strict underwriting. Best for established companies.

Business Line of Credit

Rates vary often, especially with interest rates on business lines of credit, but you only pay interest on what you use.

Merchant Cash Advance

Extremely high “factor rates”; useful only when fast capital is worth the cost.

Low-Interest Community Loans (CDFIs)

Harder to qualify for but ideal for borrowers who want low-interest small business loans and lenient support programs.

These comparisons help you compare small business loan interest rates realistically before deciding.

How to Get a Lower Interest Rate

Lower interest rates are not just luck; they are earned. Here’s how to position yourself for better pricing and reduce the lifetime cost of your loan.

- Improve Your Credit Scores: Both personal and business credit matter. Strong scores signal lower risk, which helps you secure cheaper terms.

- Boost Your Financial Strength: Higher cash flow, stable revenue, and low debt reassure lenders and directly reduce your rate.

- Offer Collateral: Secured loans often come with better pricing because lenders face less risk.

- Shorten Your Loan Term: Shorter repayment periods typically come with lower rates, though monthly payments rise.

- Choose the Right Rate Type: Fixed vs. variable small-business loan rates depend on your risk tolerance. Fixed offers stability; variable rates may start lower.

- Refinance Later: When your financials improve, refinancing a small business loan for a better rate can significantly reduce your long-term cost.

When High Interest Rates Are Worth It

Sometimes paying more today prevents far greater losses tomorrow. High-interest loans can still be smart strategic tools when timing matters more than price.

- Emergency payroll, you cannot miss

- Seasonal opportunities with guaranteed return

- Short-term inventory deals with high profit margins

- Critical equipment repairs that keep operations running

A study highlights that, in 2025, 62% of small business owners who took high-interest short-term loans for emergencies like payroll or inventory reported positive ROI exceeding borrowing costs by at least 20%, prioritizing cash flow survival over low rates.

In these moments, the cost of borrowing for small businesses becomes secondary to maintaining cash flow. If the return outweighs the interest, the loan is worth it.

Conclusion

Understanding small business loan interest rates gives you the power to borrow smarter and improve your approval odds. Compare offers carefully, strengthen your financial profile, and secure low-rate opportunities whenever they appear.

Before you apply, run your numbers.

Before you sign, understand the real cost.

And before you settle, remember: the right rate can protect your business far more than the wrong loan ever could.