If you run a small business in retail, e-commerce, or food service, you already know how unpredictable cash flow can be. When equipment breaks down or a supplier offers a limited-time deal on inventory, you may need money right away. Bank loans move slowly, which creates pressure when you’re trying to handle urgent needs.

This is when a merchant cash advance or MCA, is often promoted as a quick and simple option. It offers fast funding, easy approval, and fewer requirements, even for owners with weak credit.

The speed sounds helpful because many providers deposit funds within a day or two. Still, this support comes with serious drawbacks. MCAs operate outside traditional lending rules, which leads to confusing terms, high costs, and daily payments that strain your cash flow.

This guide explains: how does a merchant cash advance work, what the rates and fees look like, and the risks involved, so you can decide if an MCA truly supports your business.

Merchant Cash Advance Explained

At its core, a merchant cash advance is not a loan. It is essentially the purchase of a portion of your business’s future revenue. This distinction matters because it allows MCA providers to operate outside many federal and state lending rules, including regulations on interest rates and requirements for clear disclosure of costs, like the APR.

In this setup, the provider acts as the “purchaser,” and you, the business owner, are the “seller” of your expected daily or weekly credit card sales.

Typical Merchant Cash Advance Terms: Factor Rates and Holdbacks

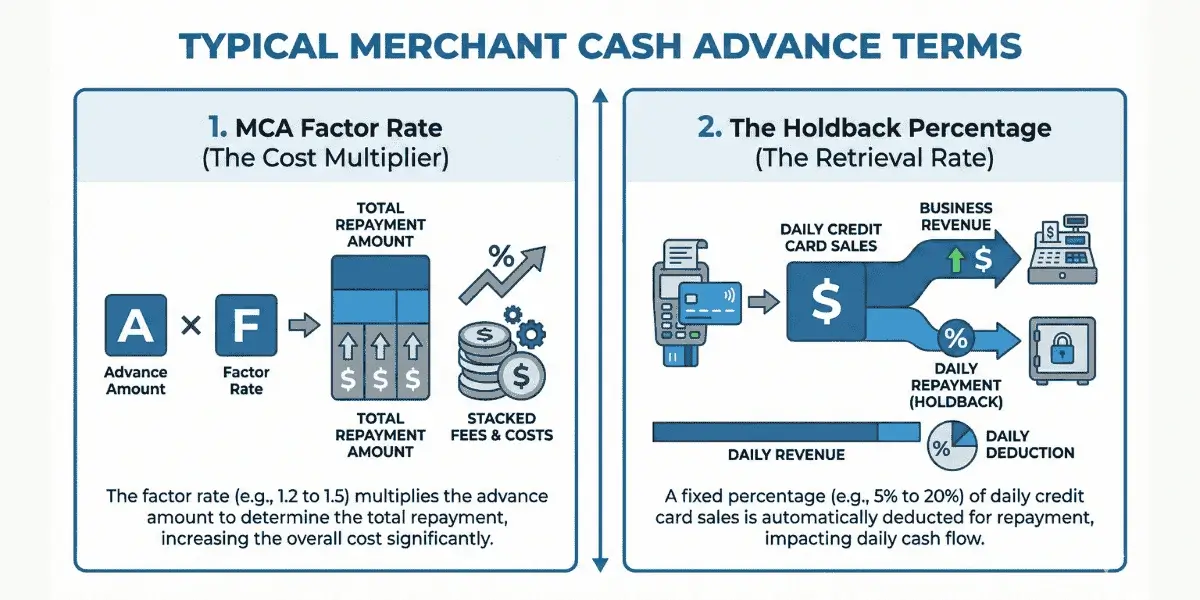

To understand how a merchant cash advance works, you need a clear grasp of two terms that shape the total cost and your daily cash flow. These are the Factor Rate and the Holdback Percentage. They decide how much you repay, how fast you repay it, and how stressful the repayment feels during slow business days.

1. The MCA Factor Rate (The Cost Multiplier)

A factor rate is a fixed decimal number, usually between 1.1 and 1.5, that sets the total amount you must repay. It replaces the traditional interest rate. This is why many providers highlight fast approval but avoid discussing the true annual cost.

A factor rate tells you the full repayment upfront, no matter how long the repayment takes. This structure is part of typical merchant cash advance terms and directly influences merchant cash advance rates and fees.

Calculation: Total Repayment Amount = Advance Amount × Factor Rate

If you receive $50,000 at a factor rate of 1.3, your obligation becomes $65,000. The difference is the fixed fee you are paying for the advance. This is why the factor rate plays such a significant role in explaining merchant cash advance pros and cons, merchant cash advance hidden costs, and why the effective APR often ends up in triple-digit territory. Even if you repay early, the fixed fee never decreases.

Merchant Cash Advance Example: The Factor Rate in Action

| Advance Amount (A) | Factor Rate (F) | Total Repayment (R = A × F) | Fixed Fee (Cost) |

| $50,000 | 1.3 | $65,000 | $15,000 |

| $50,000 | 1.5 | $75,000 | $25,000 |

In the first scenario, you pay $1.30 for every $1 you borrowed. The fixed fee represents the total cost of the advance.

2. The Holdback Percentage (The Retrieval Rate)

The holdback percentage, sometimes called the retrieval rate, is the share of your daily card sales automatically taken to repay the MCA. It usually ranges between 10% and 20%. This rate does not affect the total repayment. Instead, it affects how quickly you finish paying off the balance. This rate does not affect the total repayment. Instead, it affects how quickly you finish paying off the balance.

If your café brings in $3,000 in card sales in one day and your holdback is 12%, the MCA provider takes $360 and you keep the remaining $2,640. This setup creates the daily repayment merchant cash advance pattern many businesses find stressful, especially during slow periods.

How Factor Rate and Holdback Work Together

Both the factor rate and the holdback operate simultaneously during repayment. The factor rate sets the total amount you owe, while the holdback determines the portion of your daily sales deducted to pay that total. Repayment begins immediately after the advance is deposited, and each day a portion of your sales is applied toward the total balance.

On high-sales days, repayment accelerates; on slower days, it slows down. This ensures that the total repayment is eventually met, while daily cash flow is directly affected by your holdback.

Timing of Repayment

Repayment starts as soon as the funds are received. Daily deductions from the holdback continue until the total repayment (Advance × Factor Rate) is fully paid. Even though daily amounts vary with sales in a variable repayment structure, the total repayment never exceeds the amount set by the factor rate.

The Core Mechanism: Daily Repayment and Cash Flow Stress

Daily repayment is the core function of a merchant cash advance. It means the MCA provider collects payments every day from your revenue instead of using monthly installments. This daily pull can happen as a percentage of your sales or as a fixed deduction from your bank account. The purpose is to recover the advance quickly, but this setup places steady pressure on your working capital.

The daily repayment structure is both the main selling point of a merchant cash advance and its biggest risk. Understanding this mechanism explains how merchant cash advances work for small business operations and why they can put pressure on your cash flow.

Fixed vs. Variable Repayments

Repayments generally happen in two ways, each with its own risks:

Variable Repayment (Percentage of Sales)

This method applies a fixed percentage of your daily card sales toward repayment. The percentage stays the same, but the amount deducted rises or falls with your revenue.

This is the traditional MCA approach. Your repayment fluctuates with your sales. On a strong sales day, more is deducted; on a slower day, less. This creates a daily repayment merchant cash advance pattern.

Fixed ACH Debits (Automated Clearing House)

This method deducts a preset daily amount from your business bank account, regardless of how much revenue you produced that day. It removes flexibility and increases risk during slow periods because the deduction never adjusts with sales.

Some providers now take a fixed daily amount from your bank account, no matter your sales for the day. This removes the MCA’s key advantage, flexibility, and can be dangerous during slow periods. If revenue dips, the fixed deduction still occurs, potentially causing Non-Sufficient Funds (NSF) fees and even default.

For businesses with tight margins, daily repayments can make it hard to cover operating costs, pay staff, or settle vendor invoices. Over time, this constant cash drain can lead to a cycle of debt that is difficult to escape.

This daily structure connects directly to how the cost of an MCA is calculated, which brings us to one of the biggest issues with these advances: the real cost hidden inside the factor rate.

The True Cost Crisis: Unmasking Triple-Digit APRs

One of the biggest transparency issues with merchant cash advance rates and fees is the factor rate itself. Ignoring time, it makes the actual cost of borrowing appear lower than it really is.

Why the Factor Rate Can Be Misleading?

For example, if you borrow $50,000 with a 1.3 factor rate, you owe a fixed $15,000 fee. Whether you repay that over six months or twelve months, the total fee does not change. This “prepayment paradox” means there is no financial advantage to repaying early.

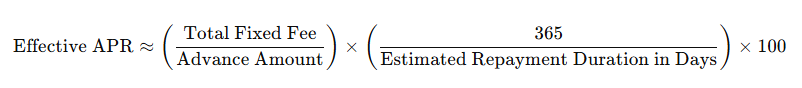

To compare this cost to regulated financing, like a traditional loan, you need to measure it over time using the Annual Percentage Rate (APR).

Calculating the Effective APR

The Effective APR converts the fixed fee into an annualized percentage based on your estimated repayment period, showing how expensive the advance really is.

Formula:

Industry analyses show that when calculated properly, MCAs can have effective APRs in the triple digits, often exceeding 350%.

APR Shock: Repayment Speed vs. Annual Cost

| Fixed Fee | Repayment Duration | Effective APR |

| $4,000 | 180 Days (6 months) | 81.11% |

| $4,000 | 90 Days (3 months) | 162.22% |

| $4,000 | 45 Days (1.5 months) | 324.44% |

Ironically, faster repayment increases the effective APR, penalizing businesses that repay quickly. This shows why MCAs rank among the most expensive forms of business financing available. If you’re unsure, you can use a merchant cash advance cost calculator to estimate your real cost.

Merchant Cash Advance Hidden Costs and the Debt Trap

Beyond the factor rate, MCAs operate with limited regulation, allowing providers to add extra fees that significantly increase the true cost of borrowing. This creates a minefield of MCA hidden costs.

The Hidden Fee Minefield

Watch for these common additional fees in MCA contracts:

- Origination and Underwriting Fees: Charges for processing the application and assessing risk. These are often deducted upfront, leaving you with less usable capital than expected.

- Administrative/Processing Fees: Ongoing or one-time fees for managing the account and daily deductions.

- Prepayment Penalties: Some contracts penalize early repayment, even though the fixed fee structure offers no savings for paying off the advance quickly.

- NSF and Late Fees: If a fixed daily ACH debit fails due to insufficient funds, providers can levy steep penalties, compounding financial stress.

Stacking: The Debt Trap

The most dangerous risk is stacking. This is one of the most common merchant cash advance horror stories, where business owners take a second or third MCA to cover existing ones.

The Pros and Cons: Is a Merchant Cash Advance a Good Idea?

MCAs solve immediate problems but carry steep costs. This section highlights merchant cash advance pros and cons business owners should weigh.

| Pros | Cons |

| Speed | Extremely High Cost: Effective APRs can exceed 350% |

| Easy Qualification | Fixed Fee Structure: No savings for early repayment |

| Poor Credit Accepted | Cash Flow Strain: Daily deductions stress working capital |

| No Collateral Required | Unregulated: Contracts and fees can be non-transparent |

| Flexible Repayment (Variable) | Hidden Fees: Includes origination, administration, and prepayment fees |

Final Assessment: An MCA suits short-term, high-ROI needs or situations where speed is critical.

The Real Risks of Merchant Cash Advances

Defaulting on an MCA can have harsher consequences than defaulting on a traditional unsecured loan. This is part of the broader risks of merchant cash advances many businesses underestimate.

The UCC Lien and Freezing of Receivables

Before funding an advance, providers usually file a Uniform Commercial Code (UCC) lien, giving them a legal claim on your future receivables.

If you default, the provider can enforce this lien aggressively, directing your payment processors or clients to send future receivables straight to them. This can immediately freeze your revenue stream and shut down your ability to operate, a reality highlighted in many merchant cash advance stories.

If you are already stuck in an MCA cycle, you can read MCA Debt Relief: Legit Options vs Scams to learn about safer ways to handle that debt.

Safer Alternatives to Merchant Cash Advances

Before choosing an MCA, look into alternatives to MCAs that offer more transparency and lower cost. The demand for fast, flexible capital has fueled the MCA market, estimated at $18.41 billion in 2024 and projected to grow to $25.38 billion in 2029. This growth underscores the need for smarter options.

1. Traditional Small Business Loans and Lines of Credit

For larger investments or longer-term needs, such as expansion or new equipment, traditional term loans from banks, credit unions, or online lenders are usually a better choice.

- Cost: Transparent APRs, typically between 6% and 30%.

- Structure: Fixed monthly payments make cash flow predictable.

- Lines of Credit: Revolving credit helps cover short-term cash flow gaps. Interest is charged only on the amount you use.

2. Invoice Factoring (Accounts Receivable Financing)

Ideal for B2B businesses with slow-paying clients, invoice factoring lets you sell outstanding invoices to a factoring company for immediate cash, minus a small fee.

- Cost: Fees usually range from 1% to 4% of invoice value, making this option far more cost-effective than an MCA.

3. Debt Consolidation

If you’re already trapped in the high-cost cycle of MCAs, consolidating them into a regulated loan can provide relief.

- Predictability: Fixed monthly payments stabilize cash flow.

- Cost Reduction: Interest-based loans allow savings if you pay off early, unlike fixed-fee MCAs.

For more insights on avoiding abusive financing, read: How to Spot Predatory Lenders in Merchant Cash Advance Deals.

Conclusion

The lure of fast capital from an MCA is understandable, especially for small businesses in high-volume, volatile industries like retail and food service. However, the structure is designed to maximize provider profit while hiding the true cost.

The fixed factor rate, daily repayment pressure, and risks such as the UCC lien make MCAs a potentially serious liability.

Before signing, always use a merchant cash advance cost calculator, or the APR formula above, to estimate the effective APR. If it nears or exceeds 100%, focus on safer, transparent alternatives. Long-term financial stability comes from regulated, predictable funding, not rapid, high-cost advances that can turn a short-term need into a lasting debt trap.