Synapse Bankruptcy 2025 and Its Impact on Fintech

The Synapse bankruptcy 2025 marks a pivotal moment in the world of fintech, disrupting a sector that many small businesses rely on for quick access to capital. Synapse was one of the most popular fintech companies offering back-end infrastructure to startups, but its sudden collapse has left many business owners in limbo.

Here’s how it’s shaking things up:

- Increased partner bank risk: Fintech firms relying on Synapse now face difficulties finding secure banking partners to continue operations.

- Disrupted funding options: Businesses using Synapse’s services may struggle to access previously available credit lines and loans.

- Rising uncertainty: As the fintech sector faces these challenges, businesses are being forced to turn to more traditional and secure funding sources.

This collapse illustrates how fragile the fintech space can be and highlights the importance of diversifying business financing strategies. As businesses scramble to adjust, it’s crucial to stay informed on how Synapse bankruptcy 2025 impacts the wider financial Market.

Understanding the MCA Crackdown and Its Effects on Business Loans

The MCA crackdown has taken center stage in reshaping how small businesses access short-term funding. For years, businesses have relied on Merchant Cash Advances (MCA) as a quick solution to cash flow issues. However, with the recent regulatory crackdown, getting an MCA is no longer as easy or as advantageous as it once was.

Key changes affecting small businesses:

- Tighter regulations: New rules place restrictions on interest rates, fees, and repayment terms, making it harder for businesses to get favorable MCA deals.

- Stricter lender oversight: There’s now increased scrutiny on lenders who offer MCAs, and businesses are facing more challenges when trying to qualify.

- Rising costs: With new regulations, businesses may face higher fees and longer repayment terms, increasing the overall cost of borrowing.

While MCA crackdowns are aimed at protecting businesses from high-cost loans, they have left many without access to the fast capital that MCAs once provided. Business owners are now being encouraged to look for alternative funding options, like SBA loans after default, as the MCA market tightens.

The Role of IRS Rulings 2025 in Shaping Business Taxation

New IRS rulings 2025 are set to change the way businesses approach tax planning and compliance. These rulings come at a time when businesses are already grappling with economic uncertainties and increased financial scrutiny, making it even more essential to stay ahead of new tax regulations.

-

Increased tax compliance

The IRS rulings 2025 bring stricter guidelines for deductions, credits, and reporting requirements. It means businesses will have to tighten their tax reporting processes to avoid audits and penalties.

-

Impact on deductions and credits

There are new restrictions on certain types of deductions, which could significantly affect businesses that previously benefited from tax breaks. Businesses need to adjust their financial strategies accordingly.

-

OCC/Fed enforcement

These rulings also bring tougher enforcement, requiring businesses to maintain proper documentation and meet stricter standards for tax filings.

The IRS rulings 2025 indicate a shift towards more rigorous financial scrutiny, making it crucial for businesses to have solid compliance frameworks in place. Failing to adjust to these changes could mean lost opportunities for tax savings and increased liability risks.

What Business Owners Need to Know About Evolve Bank Data Breach 2025?

The Evolve Bank data breach 2025 serves as a stark reminder of how data security is becoming an increasingly important factor for business owners in 2025. Evolve Bank, a prominent financial institution, suffered a significant data breach, affecting the personal and financial information of thousands of business clients.

Here’s what you need to know:

-

Data Breach Risks

With businesses increasingly relying on online banking and fintech, this breach highlights the risks involved in entrusting financial data to third-party platforms. Any business that relies on these platforms must be aware of the heightened risks.

-

CFPB Actions

The CFPB actions against data breaches like this are helping to set a precedent for stronger consumer protections. But business owners must take steps themselves to safeguard sensitive information.

If your business is impacted by the breach, you should immediately take steps to monitor credit reports and alert customers of the breach. Taking proactive measures can help mitigate the damage.

The Evolve Bank data breach 2025 has underlined the importance of investing in strong cybersecurity measures, and businesses must now be more cautious about where and how they store their financial data.

What Is The Impact of Partner Bank Risk on Your Business?

Partner bank risk is a growing concern for small businesses relying on fintech and online lenders for credit. As we’ve seen with the Synapse bankruptcy 2025, fintech companies often rely on partner banks to provide the capital needed for small businesses to thrive. But what happens when these partner banks are affected by economic changes or collapses?

Key impacts of partner bank risk:

-

Access to funds

Partner bank collapses or disruptions can make it harder for businesses to access needed capital. This has been seen in several fintech shutdowns, where businesses were left with limited funding options.

-

Uncertainty in Lending Terms

Fintech collapse 2025 has also highlighted the uncertainty businesses face when their lender’s partner banks go under. This makes it harder to negotiate favorable loan terms and may lead to higher costs for businesses.

-

Diversification Strategies

To avoid this risk, business owners should diversify their funding sources. By relying on multiple partners, such as traditional banks, CDFI small business loans, or government-backed loans, businesses can protect themselves from partner bank failures.

How the CFPB Is Changing the Game for Small Business Credit?

The CFPB actions have significantly shifted how small businesses access credit. As small businesses increasingly turn to online lenders, fintech firms, and alternative funding sources, the CFPB actions are putting the brakes on predatory lending practices.

Here’s how the CFPB is affecting small business credit:

- Stronger consumer protections

The CFPB actions are designed to ensure that small businesses aren’t being taken advantage of by predatory lenders. These actions ensure greater transparency and more equitable lending practices.

- Stricter regulations

New regulations limit the ability of lenders to impose unfair fees and interest rates, helping to create a more level playing field for borrowers.

- CFPB enforcement

The CFPB actions also come with a stronger enforcement framework, which means businesses are more likely to be protected from unfair lending practices in the future.

By staying informed about CFPB actions, business owners can better protect themselves and their businesses when applying for loans.

How the Synapse Bankruptcy 2025 and Evolve Bank Breach Relate to Small Business Lending

The Synapse bankruptcy 2025 and the Evolve Bank data breach 2025 are not isolated events. They reflect a larger trend in the fintech and financial industry that impacts small business lending. A report shows that the fintechs face high cyber risks from weak security, like Evolve Bank’s breach during Synapse issues

What business owners should know:

- Fintech and bank instability: As fintech and partner bank failures continue to occur, businesses relying on these platforms face an increased risk of financial disruptions.

- Access to funding: These events highlight the importance of having a diversified funding strategy that doesn’t rely solely on fintech and online lenders. Traditional banks and SBA loans after default offer greater stability for businesses.

By being aware of these risks, business owners can take steps to protect their businesses by seeking out more stable and reliable financial partners.

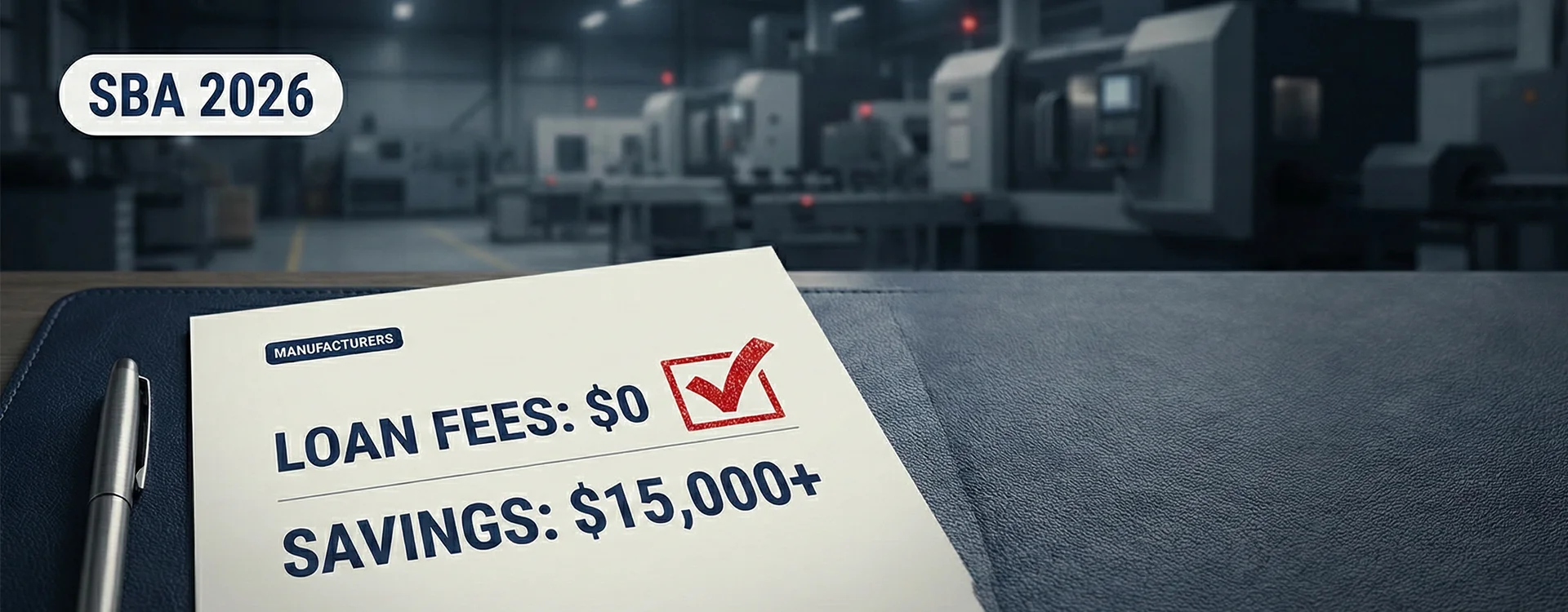

Practical Tips to Protect Your Business

Here are the practical tips you can follow to protect your business:

- Don’t rely solely on fintech and online lenders.

- Look into SBA loan after default 2025, CDFI small business loans, and other traditional funding sources.

- Keep your business credit score up to date.

- Use net-30 vendors and other strategies to build your credit history.

- Keep up with the latest financial news, such as CFPB actions and OCC/Fed enforcement, so you’re prepared for any changes in the lending Market.

Conclusion

The Synapse bankruptcy 2025, Evolve Bank data breach 2025, and MCA crackdown all highlight the importance of understanding the changing lending Market. By diversifying your funding sources and keeping your financials in order, you can ensure your business’s continued growth and a smooth access to capital.