What if your strong personal credit score could help you access large amounts of business funding without paying interest or risking your personal assets every time?

For entrepreneurs with a 725+ score, the door to 0% APR business credit cards is wide open, offering a way to fund growth using your Employer Identification Number (EIN). In this guide, you will learn how to leverage your creditworthiness to access high-limit, interest-free funding.

By focusing on 0% APR business credit cards, you can bridge cash flow gaps and scale your operations without the burden of immediate interest.

How a 725+ Score Opens Access to 0% APR Business Credit Cards

While many business owners dream of an EIN-only business credit card, the reality is that the most lucrative interest-free offers usually require a “Personal Guarantee” (PG) initially. However, there is a massive silver lining: when you have a score above 725, banks view you as a low-risk partner.

This allows you to secure 0% APR business credit cards that often do not report to your personal credit bureau, keeping your personal debt-to-income ratio pristine while you build your business empire.

A high score doesn’t just get you an approval; it gets you the highest possible limits. When applying for 0% APR business credit cards, a 725+ score can be the difference between a $5,000 limit and a $50,000 limit. This capital is essentially a “free loan” from the bank for 12 to 18 months, depending on the intro APR terms provided by the issuer.

If you want to understand EIN-only business credit in detail and learn how approval works, this guide breaks it down step by step.

Understanding EIN-Only vs. Personal Guarantee Options

If you are specifically looking for a no personal guarantee business card, you are likely looking at the world of corporate cards. These cards function differently than traditional revolving credit.

Corporate Cards EIN Path

For established businesses with significant revenue, corporate cards EIN applications are the standard. These cards, such as those from Brex or Ramp, do not require a personal credit check or a personal guarantee. Instead, they look at your business’s cash balance and monthly revenue.

The Hybrid Strategy

For most small to mid-sized business owners, the “Hybrid Strategy” is more effective. You use your 725+ personal score to qualify for 0% APR business credit cards from major lenders like Chase, American Express, or Bank of America.

Even though you provide a personal guarantee, these cards report only to the business credit bureaus (like Dun & Bradstreet or Experian Business). This allows you to use the credit for your EIN while protecting your personal score from high utilization.

Best 0% Intro APR Business Cards 2025 and 2026

As we move through 2026, the landscape for 0% intro APR business cards 2025 and beyond remains competitive. Lenders are eager to work with high-credit founders. Below is a comparison of the top offers currently available for those with a 725+ score.

Top Interest-Free Business Cards Comparison

| Card Name | Intro APR Duration | Annual Fee | Best For |

| Amex Blue Business Plus | 12 Months | $0 | General spending & Rewards |

| Chase Ink Business Unlimited | 12 Months | $0 | Flat-rate cash back |

| U.S. Bank Business Platinum | 18 Months | $0 | Longest interest-free period |

| PNC Visa Business | 13 Months | $0 | Consistent cash flow management |

The Amex Blue Business Plus remains a fan favorite because it offers 2x points on the first $50,000 spent annually, combined with a solid interest-free period. When you use 0% APR business credit cards like these, you can buy inventory, pay for advertising, or cover equipment costs today and pay them back over the next year without a penny in interest.

Business Credit Card Requirements for High-Limit Approvals

Getting approved with your EIN isn’t just about your score. You must meet specific business credit card requirements to ensure the bank sees your company as a legitimate entity.

- Legal Formation: You should have an LLC, S-Corp, or C-Corp. While sole proprietors can get these cards, having a formal structure makes you look more professional to underwriters.

- Business Bank Account: Lenders want to see that you are not co-mingling funds. A dedicated business checking account is a must.

- Professional Presence: A business phone number, a professional email (not @gmail.com), and a basic website can significantly increase your approval odds.

- Clean Personal Credit: Ensure your 725+ score doesn’t have recent late payments or high personal utilization (under 30% is ideal).

By meeting these business credit card requirements, you position yourself to receive the most competitive 0% APR business credit cards on the market.

Strategic Use of Intro APR Terms

One of the most important aspects of managing your business finances is understanding the intro APR terms. A 0% offer is a powerful tool, but it is not a “set it and forget it” solution.

- The Expiration Date: Always mark the month the 0% period ends. If you carry a balance past this date, the interest rate can jump to 16%–28% instantly.

- Minimum Payments: You must still make the minimum monthly payment. Failing to do so can void your 0% offer and damage your credit score.

- The “Debt Shuffle”: Many savvy entrepreneurs use 0% APR business credit cards to pay off high-interest debt or to fund a project that will generate ROI before the intro period expires.

Pro Tip: If you have a massive project that will take 18 months to pay off, prioritize cards like the U.S. Bank Business Platinum, which often features the longest durations in the industry.

Building an EIN-Only Profile with No Personal Guarantee

If your goal is to eventually move away from personal guarantees entirely, you must use these cards to build your business credit profile. While you enjoy the benefits of 0% APR business credit cards, your on-time payments are being reported to business credit bureaus.

Once your business has a strong “Paydex” score (Dun & Bradstreet) or a high Experian Business score, you can apply for a no personal guarantee business card with much higher success. Companies like Divvy (now BILL) and Ramp provide excellent platforms for managing spending once your business has established its own credit identity.

These corporate cards EIN options are the “end game” for many founders who want to completely decouple their personal finances from their business risks.

How to Apply for 0% APR Business Credit Cards Today

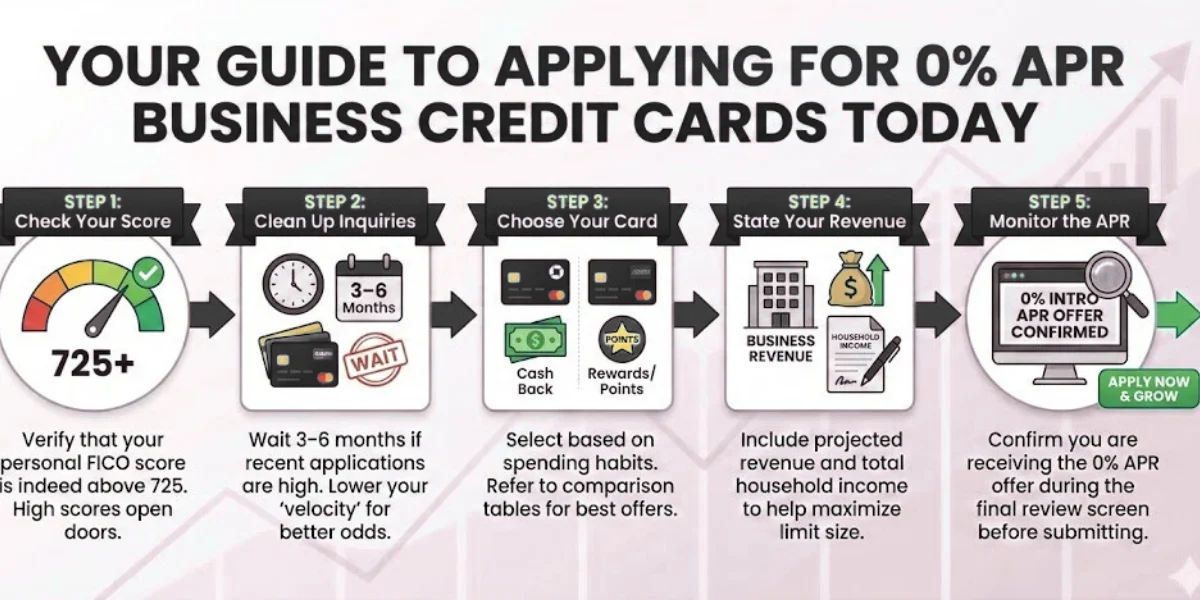

Ready to take action? Follow these steps to maximize your chances:

- Check Your Score: Verify that your personal FICO score is indeed above 725.

- Clean Up Inquiries: If you have applied for many cards recently, wait 3–6 months to ensure your “velocity” isn’t too high.

- Choose Your Card: Based on the table above, select the card that fits your spending habits (e.g., Chase for cash back, Amex for points).

- State Your Revenue: Don’t be afraid to include projected revenue or your total household income if the application allows it. This helps with limit size.

- Monitor the APR: Confirm you are receiving the 0% APR business credit cards offer during the final review screen of the application.

Conclusion

Leveraging your 725+ score to access 0% APR business credit cards is one of the smartest financial moves you can make as an entrepreneur. By utilizing these interest-free windows, you can invest in your company’s future without the drag of high-cost debt.

Whether you choose a high-rewards card like the Amex Blue Business Plus or aim for a no personal guarantee business card later in your journey, the key is to start now.

Secure your 0% APR business credit cards today, manage your cash flow wisely, and watch your business reach new heights of success.