Financing Your First Employee: Payroll Funding for Small Businesses

Why Hiring Your First Employee Requires Financial Planning Hiring your first employee isn’t just an exciting milestone. It is a big financial shift that requires dependable cash flow. Payroll is recurring, predictable, and unforgiving, so planning ahead protects both your business and your new hire. Here’s why financial prep matters before you onboard someone: Payroll […]

How to Rebuild Your Business Credit After Bankruptcy or Default

Filing for bankruptcy feels like hitting a brick wall. The silence after the phone stops ringing is a relief, but it is quickly replaced by the anxiety of a tarnished reputation. You might be wondering if your entrepreneurial journey is over. It isn’t. While the road ahead is steep, rebuilding business credit after bankruptcy is […]

Small Business Loan Interest Rates: How they Affect You?

Understanding Small Business Loan Interest Rates It is important to understand what small business loan interest rates actually represent. At the simplest level, your interest rate is the lender’s price for taking a risk on your business. But in 2025, small-business loan interest rates fluctuated frequently in response to inflation, Federal Reserve decisions, the economy, […]

What Small Business Loan Underwriters Actually Look For?

What Is Small Business Loan Underwriting? Small business loan underwriting is the behind-the-scenes evaluation lenders use to determine whether your business is financially strong enough to borrow money. Think of it as a detailed risk assessment in which every part of your financial picture is examined. Underwriting matters because it directly affects whether you get […]

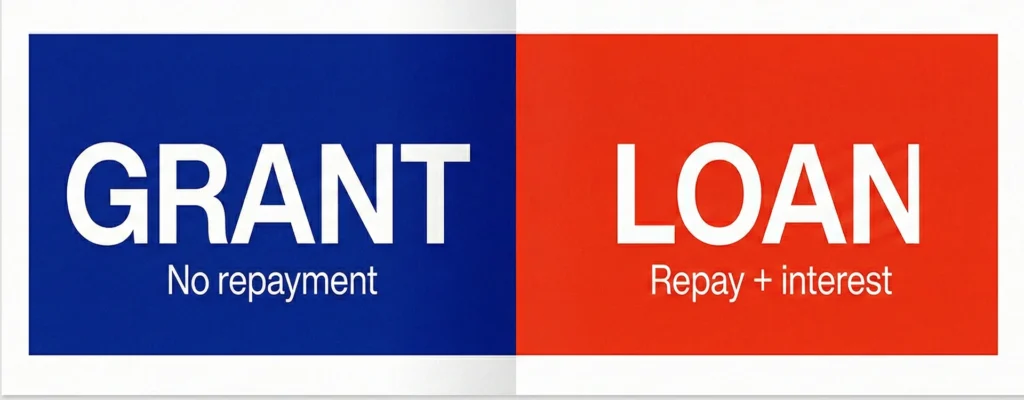

Small Business Grant vs Loan: Which Is Better for You?

If you are stuck choosing between a small business grant and a loan, you are not alone. Most business owners hit this exact roadblock the moment they start looking for money to grow. Both options sound promising, but they work in completely different ways. Picking the wrong one can slow you down or cost you […]

MCA Debt Relief: Legit Options vs Scams

For many business owners, the most stressful part of the day is the morning bank balance check. Seeing your hard-earned revenue vanish via automatic daily withdrawals before you have even paid your staff is a suffocating feeling. You are certainly not alone in this struggle; industry data suggests that effective APRs on these advances frequently […]

Top Business Loans for Bad Credit: 7 Funding Options

How to Overcome Bad Credit and Secure Business Funding For many small business owners, bad credit feels like a barrier to growth. However, it doesn’t have to stop you. While traditional lenders might reject your application, business funding for bad credit has got you covered for your needs. Today, there are more alternative business financing […]

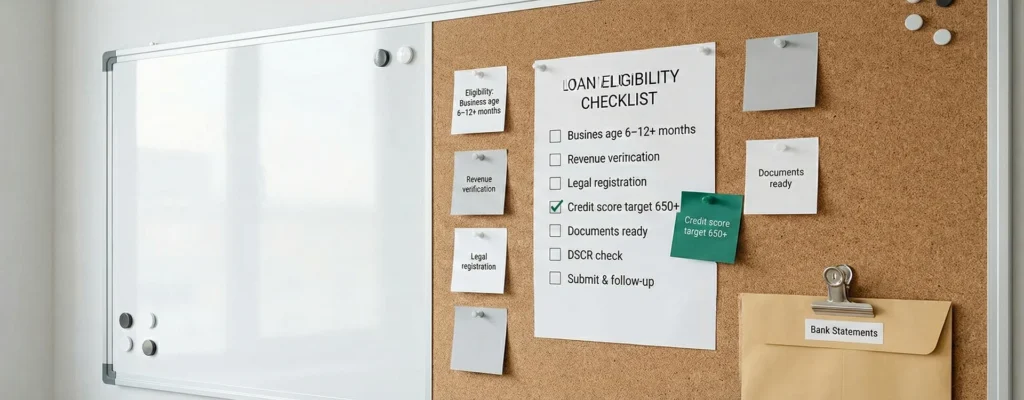

How to Get Approved for Small Business Loans in 2026

As a business owner, you have probably felt the weight of needing funding but struggling to get approval. No doubt that it is a tough spot, especially in 2026 when lenders have tightened the strings. But getting a small business loan doesn’t have to be a mystery. Understanding the approval process and what lenders are […]

Predatory Lenders Merchant Cash Advance: How to Spot the Risks

Am I Dealing with Legitimate or Predatory Lenders? The first step is distinguishing between a legitimate, albeit expensive, financing product and a predatory one. A legitimate MCA is not technically a loan; it is the purchase of your future receivables. This distinction allows predatory lenders to bypass state merchant cash advance usury laws that typically […]

Merchant Cash Advance: How It Works & Hidden Costs

If you run a small business in retail, e-commerce, or food service, you already know how unpredictable cash flow can be. When equipment breaks down or a supplier offers a limited-time deal on inventory, you may need money right away. Bank loans move slowly, which creates pressure when you’re trying to handle urgent needs. This […]