How WaterWorks Agency Is Quietly Reshaping American Business – One Owner at a Time

The blueprint, the credit architecture, and how we are pulling entrepreneurs out of MCA debt and into long-term leverage. Most people never see them, the business owners driving America forward long before sunrise. They unlock their shop at 5 a.m., run crews all day, handle invoicing at night, and collapse into bed only to repeat […]

You’re Using MCA Loans Wrong — Here’s How One Woman Wiped Out $60K Without Going Bankrupt

Why Merchant Cash Advance Debt Relief is the Solution You Haven’t Considered Most small business owners treat a Merchant Cash Advance (MCA) like a traditional bank loan. That is your first mistake. An MCA is technically a “purchase of future receivables.” Because it isn’t legally a loan, it isn’t bound by the same usury laws […]

Why the FTC Is Finally Cracking Down on Predatory Lending in 2026

In 2026, the way federal agencies protect consumers and small business owners is changing like never before. For years, some lenders took advantage of loopholes, operating in ways that were unfair or hidden. That era is officially ending. The FTC crackdown predatory lending 2026 is in full swing, with the agency stepping up enforcement through […]

The Freedom Letter: Why We Send Free Credit Disputes Every Month

Have you ever felt like your credit score is a heavy chain holding you back from the life you truly deserve? Whether it’s a denied car loan, a rejected rental application, or a sky-high interest rate on your dream home, a low score feels incredibly personal. But here is a secret the banks don’t want […]

How to Turn a 640 Into a 720—Without Paying for Tradelines

Having a credit score of 640 puts you in a frustrating middle ground. You aren’t in the “poor” category, but you are stuck in the “fair” range, just high enough to get approved for some credit, but low enough to face higher interest rates. If you’re wondering how to increase credit score fast, moving from […]

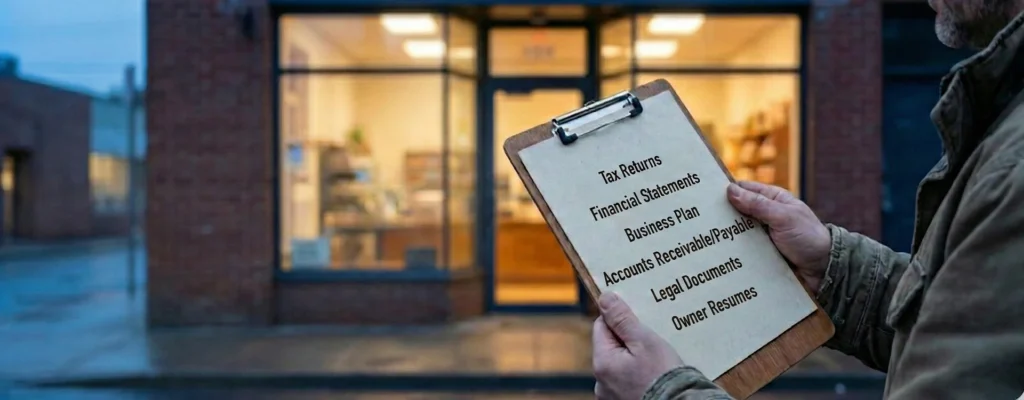

Everything We Wish We Knew Before Our First Business Loan

Securing your first major round of capital is a milestone for any entrepreneur, but the process is rarely straightforward. When you start looking into how to get a business loan, the sheer number of financial terms and acronyms can feel overwhelming. From our experience, there are several key details that, if understood early, could save […]

Access to Business Credit: The Case for Business Credit as a Human Right

Business credit is often considered a privilege, but what if we saw it as a fundamental right? An analysis shows that 39% of Black-owned businesses got denied loans, compared to just 18% for white-owned ones. These gaps hit underserved entrepreneurs hardest, blocking their shot at growth and widening inequality. The lack of access to business […]

How One Aged Corporation Gave a Founder $200K in 90 Days

A founder with steady revenue kept hearing the same answer from lenders: Come back later. Cash was needed now, not in years. The turning point wasn’t a hack, but a shelf corporation used correctly. According to the World Bank Group, around 30% of small firms worldwide report being credit-constrained, meaning financing options are limited or […]

2025 Small Business Tax Changes: What Congress Doesn’t Want You to Overlook

A surprising number of small business owners will pay more tax in the coming year without realizing anything has changed. Not because they made mistakes, but because they missed quiet rule updates buried in fine print. A recent survey found that more than 60% of gig economy workers did not know the tax reporting threshold […]